In the world of luxury sports watches, the conversation inevitably gravitates toward Patek Philippe’s Nautilus or Audemars Piguet’s Royal Oak—watches that dominate Instagram feeds, command $80,000–$150,000 secondary market premiums, and maintain multi-year waiting lists at authorized dealers. Yet this obsessive focus on the brand duopoly blinds collectors to a watch that, objectively speaking, might represent superior value: the Vacheron Constantin Overseas.

The Overseas exists as the “thinking man’s” alternative to Patek Philippe hype—a watch that delivers cutting-edge horology, distinguished design, and remarkable versatility at substantially more reasonable price points and, paradoxically, with slightly better availability despite lower brand recognition. While the Nautilus trades for 2–3x retail and the Royal Oak regularly exceeds $60,000 grey market, the Overseas 4500V blue dial averages just $26,000–$31,000 grey market against $25,000 MSRP—a mere 4–24% premium. For collectors prioritizing horological excellence over brand status, this pricing disparity represents an extraordinary opportunity.

Generation Overview: From 1996 Launch to 2016 Revolution

The Vacheron Constantin Overseas traces its lineage to the 1977 Reference 222, a sports watch that predated both the Nautilus (1976) and Royal Oak (1972) by years, yet never achieved comparable cultural significance.

Generation 1 (1996–2004): The Foundation

When Vacheron Constantin launched the Overseas ref. 42040 in 1996, the brand intended a sports watch for global travelers—elegant enough for formal occasions yet robust enough for adventure. Measuring 37mm with a 1310 caliber movement (Girard-Perregaux sourced), the original Overseas delivered remarkable refinement through extreme thinness and integrated design.

Critical distinction from competitors: While the Nautilus emphasized pure minimalism and the Royal Oak celebrated engineering visibility, the Overseas balanced both philosophy—offering both functional elegance and accessible design coherence.

Generation 2 (2004–2016): The Muscular Era

By 2004, Vacheron Constantin recognized that market preferences had shifted toward bolder proportions. The Generation 2 Overseas jumped to 42mm and adopted the Maltese cross-adorned bracelet that became iconic to the line.

This generation introduced VC1126 and VC1137 movements (Jaeger-LeCoultre sourced), and the design adopted what critics called “brutalism”—squarer, more angular proportions reflecting mid-2000s aesthetic preferences.

Generation 3 (2016–Present): The Renaissance

In 2016, Vacheron Constantin completely reimagined the Overseas under lead designer Vincent Kaufmann. This wasn’t evolution—it was revolutionary.

- Case: Refined from angular brutalism to fluid, barrel-shaped proportions

- Dial: Upgraded to smooth, gradient lacquer (blue, black, silver options)

- Bezel: Reduced from eight notches to six (referencing the Maltese cross’s geometric harmony)

- Movement: Upgraded to the in-house Caliber 5100 with Geneva Seal certification

- Bracelet: Redesigned with refined Maltese cross links

- Strap System: Introduced the revolutionary quick-change mechanism (no tools required)

This generational leap fundamentally repositioned the Overseas from “brutalist sports watch” to “refined luxury instrument,” instantly narrowing the visual gap between it and the Nautilus/Royal Oak competitors.

The Maltese Cross: Design DNA

The Maltese cross represents Vacheron Constantin’s signature design language, adopted officially in 1877 yet referenced in the brand’s watchmaking since 1790.

Vacheron Constantin chose the Maltese cross because it mirrors the Geneva stopwork component—a mechanical element that regulated barrel rotation within movements. The cross’s four equal arms suggest perfect mechanical balance and precision.

- Bezel notches: The six-notch configuration represents the Maltese cross’s geometric harmony

- Bracelet links: Half-Maltese cross motifs appear subtly on center links

- Indices/hour markers: Cross-shaped markers at 12, 3, 6, 9 o’clock positions

- Rotor/caseback: 22K gold rotor displays an engraved compass rose

This omnipresent design language unifies the Overseas collection while remaining understated enough to avoid self-parody—a design sophistication lost on competitors chasing visual boldness.

The Quick-Change Strap System: Unmatched Versatility

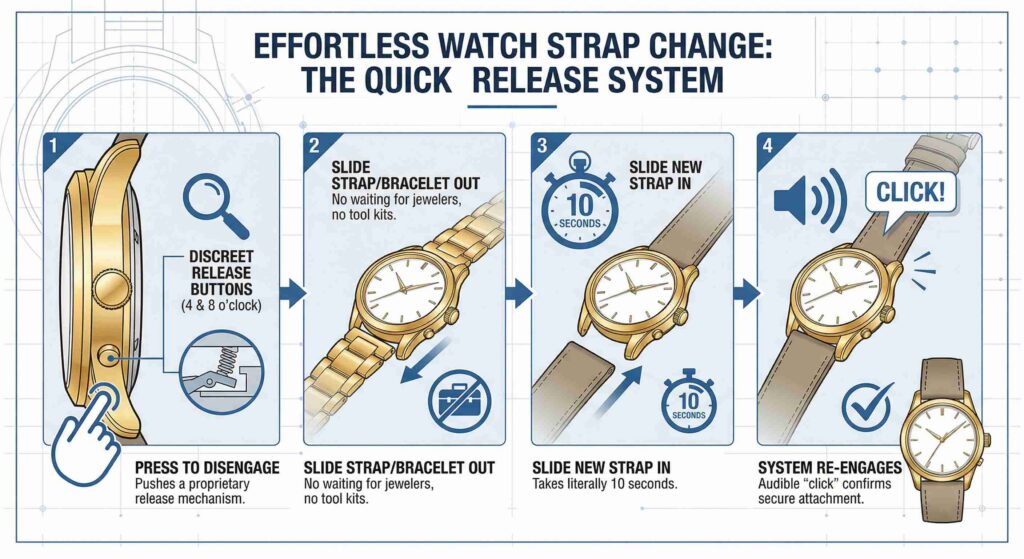

Here’s where the Overseas genuinely outperforms every competitor: Vacheron Constantin engineered a strap-interchange system that requires zero tools and functions flawlessly across interchangeable steel bracelet, rubber, and leather options.

How It Works:

- Release button: Located discretely between the case lugs at 4/8 o’clock positions

- Press to disengage: Pushes a proprietary release mechanism

- Slide strap/bracelet out: No waiting for jewelers, no tool kits

- Slide new strap in: Takes literally 10 seconds

- System re-engages: Audible “click” confirms secure attachment

This innovation wasn’t marketing gimmick—it fundamentally solved a genuine luxury watch problem. The Nautilus and Royal Oak require authorized dealer visits or specialized tools for bracelet changes; the Overseas transitions seamlessly across three distinct aesthetic personas in seconds.

Practical impact: You can wear the Overseas on steel bracelet for professional contexts, transition to rubber for casual activity, and switch to leather for evening—something the Nautilus literally cannot accommodate without technical intervention.

The Critical Caveat:

Third-party leather strap manufacturers (De Lugs, Horsebit) have reverse-engineered adapters to accommodate custom leather straps with the quick-change system, creating infinite customization options unavailable for Nautilus/Royal Oak owners.

The Blue Dial Premium: Why Color Commands Attention

Of all Overseas configurations, the blue dial (reference 4500V/110A-B128 or 4520V-210A-B128) commands sustained premium pricing despite representing a minority of overall production.

Current pricing (November 2025):

- Black or silver dial: $21,800–$25,000 grey market (effectively at retail or slight discount)

- Blue dial: $26,000–$31,000 grey market ($25,000 MSRP = 4–24% premium)

- Rare colorways (green, etc.): Variable, historically $35,000–$55,000

Why the blue dial specifically?

The gradient sunburst blue lacquer captures light with more complexity than flat black or silver, creating dimensional depth that photographs beautifully and performs exceptionally in varied lighting conditions. From boardroom fluorescence to natural sunlight, the blue dial’s reflective properties remain visually arresting.

Additionally, the blue dial pairs identically with both professional and casual aesthetics—unlike black dials (perceived as formal-only) or silver dials (perceived as corporate-plain). The blue’s psychological positioning as “luxury without obviousness” resonates with collectors who appreciate subtle color expression.

Investment Reality: Still Undervalued vs. Nautilus?

| Metric | Patek Philippe Nautilus | Vacheron Constantin Overseas | Audemars Piguet Royal Oak |

|---|---|---|---|

| MSRP (Entry) | $36,000 | $25,000 | $30,000 |

| Grey Market Average | $65,000–$95,000 | $26,000–$31,000 | $43,000–$75,000 |

| Premium Over Retail | 81–164% | 4–24% | 43–150% |

| Appreciation Rate (10-year) | 120–180% | 60–90% | 80–140% |

| Annual Appreciation | ~8–12% | ~4–6% | ~6–10% |

| Availability | Multi-year waiting lists | 12–36 months | 24–48 months |

| Secondary Market Volume | Extremely high (speculative) | Moderate | High |

The uncomfortable truth: The Overseas does not appreciate as aggressively as the Nautilus because Vacheron Constantin lacks the cultural cachet and artificial scarcity that Patek Philippe commands. Collectors purchasing Overseas watches should expect 5–7% annual appreciation—respectable by historical standards but substantially below Nautilus expectations.

However, this “underperformance” exists precisely because the Overseas isn’t experiencing speculative bubble inflation. You’re paying closer to intrinsic value—excellent Swiss horological engineering with Geneva Seal certification—rather than paying Nautilus-level premiums driven by brand status and Instagram aesthetics.

Availability: Slightly Less Impossible Than Competitors

One genuine advantage: Vacheron Constantin Overseas availability slightly exceeds Nautilus/Royal Oak access, particularly for non-blue configurations.

Current waitlist timelines (November 2025):

- Vacheron Constantin Overseas (any dial): 12–36 months

- Vacheron Constantin Overseas (blue dial specifically): 18–48 months

- Patek Philippe Nautilus: 36–72+ months

- Audemars Piguet Royal Oak: 24–60 months

Reddit communities suggest that establishing AD relationships through prior purchases can reduce Overseas waitlists to 12–24 months, whereas Nautilus waits rarely drop below 36 months regardless of purchase history.

The Value Proposition: Why Overseas Makes Sense in 2025

Choose the Vacheron Constantin Overseas if:

- You prioritize horological engineering over brand status

- You value design refinement and versatility (quick-change system)

- You appreciate understated elegance over visual maximalism

- You want strong value retention (60–90% appreciation) without speculative bubble inflation

- You’re willing to accept slightly lower resale multiples (4–24% grey market vs. Nautilus’s 81–164%) in exchange for lower entry cost and better availability

- You prefer Geneva Seal certification (objective quality standard) over brand prestige alone

Don’t choose the Overseas if:

- You’re buying exclusively for investment appreciation

- You prioritize brand recognition and status signaling

- You want the “safest” investment (Nautilus historically appreciates more aggressively)

- You need maximum resale liquidity (Nautilus/Royal Oak have larger secondary markets)

Conclusion: The Intelligent Collector’s Choice

The Vacheron Constantin Overseas occupies a rare market position—genuinely excellent without the hype tax. It delivers cutting-edge horology (Geneva Seal, in-house 5100 movement, 60-hour power reserve), distinguished design (Maltese cross integration, refined proportions), and unprecedented versatility (quick-change strap system) at substantially more accessible price points and waiting times than competitors.

While it may never match the Nautilus’s investment appreciation or the Royal Oak’s cultural cachet, the Overseas rewards informed collectors who prioritize watches over brand logos. It’s the timepiece for those willing to pay for excellence rather than hype—and in 2025’s inflated luxury market, that distinction increasingly matters.

The Overseas isn’t underrated. It’s undervalued. And for collectors discerning enough to notice the difference, that represents extraordinary opportunity.