The Rolex Submariner stands as the undisputed benchmark for luxury sports watches, commanding respect from collectors, investors, and enthusiasts worldwide. In today’s market, understanding the stark disconnect between manufacturer’s suggested retail price (MSRP) and actual market values has become essential for anyone considering a Submariner purchase or investment. Current data reveals that most steel Submariner models trade 35-51% above MSRP, while precious metal variants often sell at discounts of up to 28% below retail prices. This comprehensive analysis examines the complex pricing dynamics that make the Submariner both a coveted timepiece and a sophisticated investment vehicle, revealing why MSRP has become merely an anchor point in a market driven by scarcity, speculation, and cultural cachet.

Why the Submariner is Rolex’s Most Iconic Sports Watch

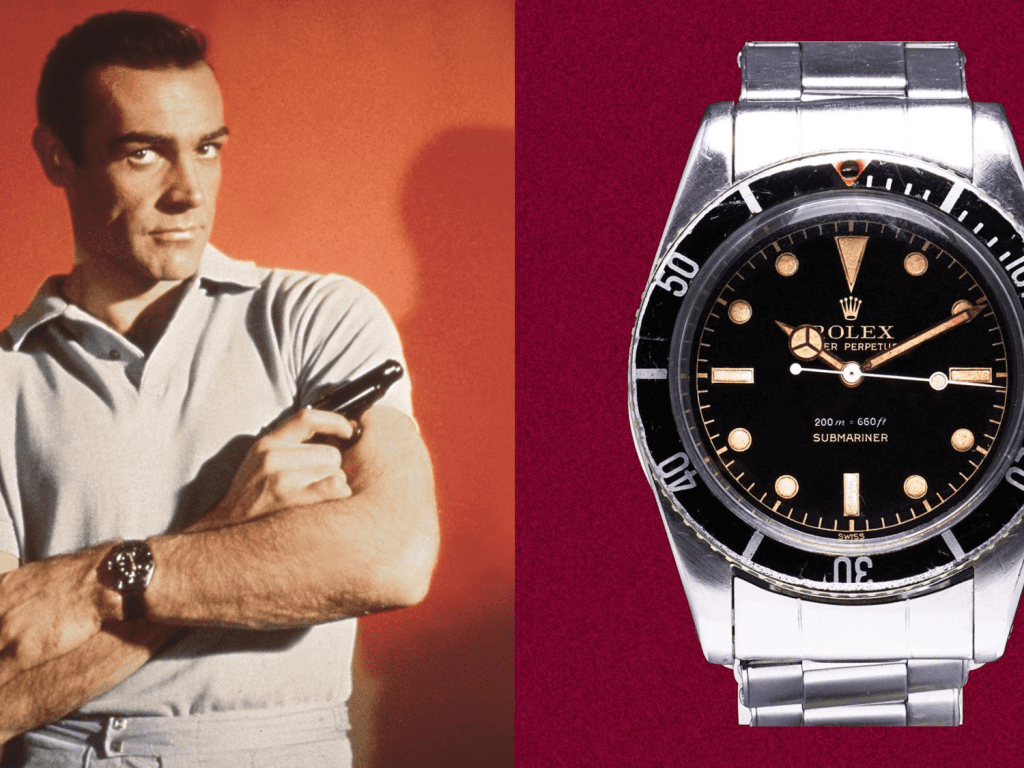

The Rolex Submariner’s journey from professional dive tool to luxury icon represents one of the most remarkable transformations in horological history. Introduced in 1953 as a practical instrument for professional divers, the Submariner has evolved into what industry experts consider the definitive luxury sports watch. Its cultural significance extends far beyond its technical specifications, having been worn by James Bond in seven films from 1962 to 1989, cementing its status as a symbol of sophistication and adventure.

The Submariner’s iconic status rests on several foundational elements that distinguish it from competitors. Its instantly recognizable design language—featuring the rotating bezel, Mercedes hands, and Cyclops lens—has remained remarkably consistent across seven decades of production. This design stability, combined with Rolex’s relentless focus on quality and precision, has created what collectors refer to as “generational appeal,” where vintage models from the 1960s share visual DNA with contemporary pieces.

Market data underscores the Submariner’s dominance in the luxury sports watch segment. Industry estimates suggest that Submariner models account for 10-15% of Rolex’s total annual production, translating to approximately 100,000-150,000 units per year. Despite this substantial production volume, demand consistently outstrips supply, creating the persistent market premiums that define the contemporary Submariner market.

The model’s investment credentials further solidify its iconic status. Recent analysis indicates that Submariner investments have generated average returns of 24% annually, significantly outperforming traditional investment vehicles. This performance stems from the watch’s unique position as both a functional luxury good and a store of value, appealing to diverse buyer segments from tool watch enthusiasts to serious collectors.

Historical MSRP Growth vs Secondary Market Appreciation

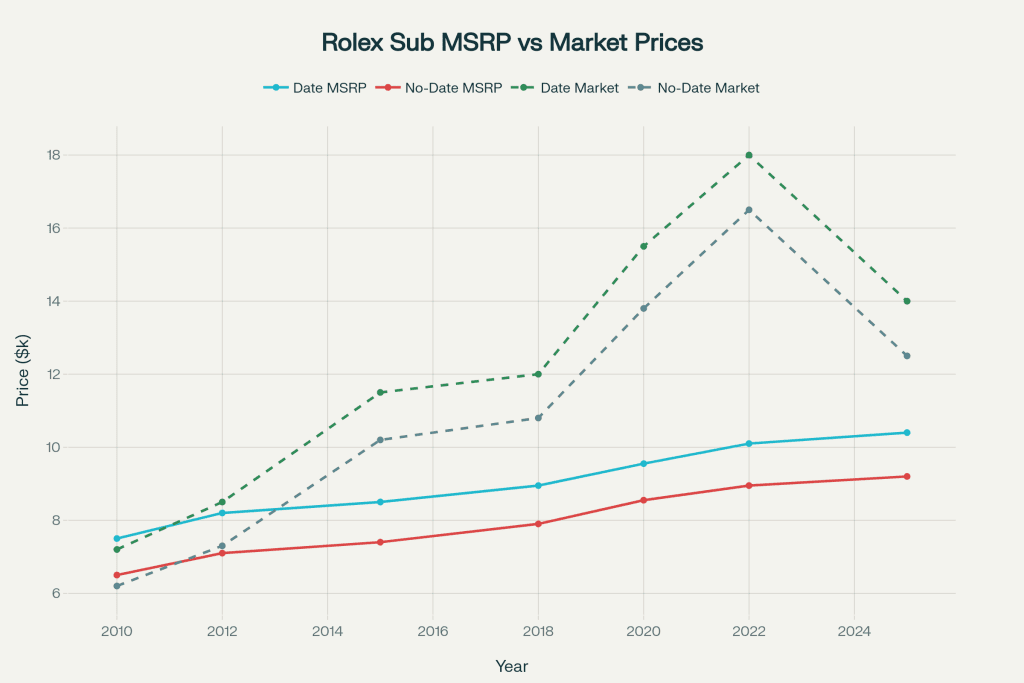

The evolution of Rolex Submariner pricing over the past fifteen years reveals a fascinating divergence between official retail prices and market realities. MSRP increases have followed a relatively predictable trajectory, with Rolex implementing annual price adjustments averaging 3-7% to account for inflation, material costs, and market positioning. However, secondary market values have exhibited dramatically different behavior, creating opportunities and challenges for collectors and investors alike.

Historical data demonstrates that MSRP growth has been remarkably consistent but conservative. The Submariner Date, for example, increased from $7,500 in 2010 to $10,400 in 2025—a compound annual growth rate of approximately 2.3%. This measured approach to pricing reflects Rolex’s long-term brand strategy, prioritizing stability and accessibility over short-term profit maximization.

Secondary market appreciation tells a more complex story. The same Submariner Date that retailed for $7,500 in 2010 commanded approximately $7,200 in the secondary market initially—a slight discount reflecting normal used watch depreciation patterns. However, by 2022, secondary market prices had surged to $18,000, representing a staggering 150% premium over MSRP before settling to current levels around $14,000.

The Rolex Submariner 116610LV “Hulk” exemplifies this market volatility most dramatically. Originally retailing for approximately $9,050 when introduced in 2010, the Hulk initially traded below MSRP in secondary markets. Market sentiment shifted dramatically around 2019 as discontinuation rumors circulated, driving prices upward. Following its official discontinuation in 2020, Hulk prices reached peak levels exceeding $30,000 in 2021 before stabilizing around $16,300—still representing an 80% premium over original MSRP.

This volatility reflects several market dynamics unique to the luxury watch sector. Economic cycles, cryptocurrency booms, and celebrity influence have all contributed to dramatic price swings. The COVID-19 pandemic particularly intensified luxury watch demand as affluent consumers redirected spending from experiences to tangible goods.

Steel vs Precious Metal Models

The performance gap between stainless steel and precious metal Submariner models represents one of the most significant trends in contemporary luxury watch markets. This divergence challenges traditional luxury goods pricing assumptions and provides crucial insights for collectors and investors navigating the Submariner landscape.

Stainless steel Submariner models consistently command substantial premiums above MSRP, with current data showing the 41mm Submariner Date (126610LN) trading 35% above its $10,400 retail price at approximately $14,000. The no-date variant (124060) performs similarly, commanding $12,500 against a $9,200 MSRP—a 36% premium. These premiums reflect the fundamental scarcity of steel sports models at authorized dealers, where wait times typically range from 4 months to 3 years.

Precious metal variants exhibit opposite market behavior, with most trading below MSRP despite their significantly higher retail prices. The yellow gold Submariner Date (126618LN) retails for $43,500 but typically sells for approximately $38,000—a 13% discount. White gold models show even larger discounts, with the 126619LB trading at $33,600 against its $46,600 MSRP—a substantial 28% markdown.

This pricing inversion stems from several structural factors in the luxury watch market. Steel models benefit from broader appeal and accessibility, attracting both enthusiasts and investors who view them as “democratic luxury”. The $10,400 entry point for a steel Submariner Date, while substantial, remains accessible to upper-middle-class professionals, creating a large potential buyer pool.

Gold models face different market dynamics. Their $40,000+ price points limit the buyer pool to ultra-high-net-worth individuals who often prefer even more exclusive pieces. Additionally, gold’s intrinsic value creates a pricing floor that can work against market premiums—buyers understand they’re paying primarily for gold content rather than scarcity premium.

Liquidity considerations further favor steel models. Industry data indicates steel Submariners sell approximately 3-4 times faster than precious metal variants, with “excellent” liquidity ratings compared to “fair” ratings for gold models. This liquidity premium compounds over time, as investors recognize the superior exit flexibility of steel pieces.

Two-tone models occupy a middle ground in this pricing hierarchy. The 126613LN (steel and yellow gold) retails for $17,000 but trades closer to $15,600—a modest 8% discount. This positioning reflects their appeal to buyers seeking gold aesthetics at more accessible price points, though they lack the pure investment appeal of all-steel variants.

New vs Discontinued

The dynamics between current production and discontinued Submariner references reveal crucial insights about collector psychology, market timing, and long-term value retention. The 2020 introduction of the 41mm Submariner collection created a unique natural experiment in how markets value “old” versus “new” in luxury watch collecting.

When Rolex unveiled the 41mm Submariner references (126610LN, 124060, and 126610LV) in September 2020, replacing the long-running 40mm generation, market reactions were swift and dramatic. The new 126610LN initially commanded substantial premiums, reaching $18,000-20,000 in secondary markets during the first year of production—nearly double its $10,400 MSRP. This “hype premium” reflected pent-up demand and the excitement surrounding the first major Submariner redesign in over a decade.

Conversely, the discontinued 40mm references experienced immediate appreciation upon their official discontinuation. The 116610LN, which had traded around $12,000-13,000 in early 2020, quickly appreciated to $15,000-16,000 as collectors recognized its “final generation” status. This pattern reflects a well-documented phenomenon in luxury collecting where discontinuation creates immediate scarcity premium.

However, market behavior has evolved significantly as initial enthusiasm moderated. Current data shows the 41mm 126610LN trading at $14,000, while the discontinued 40mm 116610LN commands approximately $10,000. This $4,000 gap reflects several factors: the newer model’s enhanced specifications (72-hour power reserve vs. 48 hours), updated proportions, and contemporary certification standards.

The vintage 16610LN from the five-digit era (1988-2010) presents yet another pricing tier, currently trading around $8,800. Despite its age, this reference maintains strong demand due to its “classic proportions,” aluminum bezel insert, and historical significance as the last truly “tool watch” Submariner before the luxury sports watch transformation.

Neo-vintage collecting trends particularly favor references from the 1980s and 1990s, driven by buyers who associate these pieces with the Submariner’s “golden era” before widespread luxury market speculation. The 16610’s 22-year production run (1988-2010) created substantial supply, making it relatively accessible for collectors seeking vintage authenticity without extreme rarity premiums.

Condition and documentation significantly impact pricing across all generations. A well-preserved 16610 with box and papers commands premiums of 20-30% over similar pieces lacking documentation. This “full set” premium reflects the increased importance of provenance in contemporary collecting markets.

Regional MSRP Disparities and Arbitrage

Global pricing disparities for Rolex Submariner models create both opportunities and complexities for international buyers, revealing how currency fluctuations, tax policies, and local market dynamics influence luxury goods pricing. These variations have spawned a sophisticated gray market ecosystem that adds layers of complexity to Submariner acquisition strategies.

Regional MSRP variations for the Submariner Date 126610LN demonstrate significant disparities across major markets. United States pricing at $10,400 represents the baseline, while European markets typically price the same model around €10,500 ($11,200 USD equivalent). United Kingdom pricing at £9,100 ($11,600 USD equivalent) reflects both local tax structures and Brexit-related adjustments.

Asian markets show even greater complexity in pricing structures. Hong Kong’s HK$84,400 ($10,800 USD equivalent) represents one of the more competitive official pricing levels globally. Japan’s ¥1,481,700 ($10,200 USD equivalent) positioning reflects the yen’s recent weakness and Rolex’s strategy to maintain local market competitiveness.

However, these MSRP disparities pale compared to secondary market variations. European secondary markets often show smaller premiums (15-20%) compared to United States markets (35%), reflecting different supply-demand dynamics and collector behaviors. This creates potential arbitrage opportunities for international buyers willing to navigate import duties and documentation requirements.

Tax considerations significantly impact net pricing for international purchases. European Union buyers benefit from VAT reclaim opportunities on purchases outside the EU, potentially reducing effective prices by 20-25%. However, import duties and documentation requirements often offset these savings, creating complex calculations for cross-border purchases.

The gray market has evolved sophisticated logistics to exploit these disparities. Professional dealers routinely purchase inventory in lower-cost markets for resale in higher-premium regions. This activity helps equalize global pricing over time but creates additional friction and costs in the acquisition process.

Currency fluctuations add another layer of complexity to international Submariner markets. The dollar’s strength against European currencies in 2022-2023 made European purchases particularly attractive for American buyers, though recent currency stabilization has reduced these opportunities.

Authentication and warranty considerations complicate international purchases. Rolex’s warranty terms vary by region, and gray market pieces may lack full warranty coverage. Additionally, the rise in sophisticated counterfeits makes authentication crucial for cross-border transactions, adding costs and complexity to international arbitrage strategies.

Factors Driving Market Premiums

The substantial premiums commanded by stainless steel Submariner models above MSRP result from a complex interplay of supply constraints, cultural influence, and macroeconomic factors that have fundamentally altered luxury watch market dynamics over the past decade.

Authorized dealer scarcity represents the primary driver of market premiums. Current wait times for steel Submariner models range from 4 months to 3 years at authorized dealers, with many dealers maintaining informal allocation systems rather than transparent waitlists. Recent data indicates median wait times have decreased from 105 days in 2023 to 60 days in 2024 for basic Submariner models, suggesting some supply improvement, though demand continues to exceed availability.

Production constraints contribute significantly to supply-demand imbalances. Despite Rolex reportedly manufacturing approximately 100,000-150,000 Submariner units annually, this represents only 10-15% of total Rolex production across all references and metal combinations. Industry analysts estimate that steel models account for roughly 60-70% of Submariner production, creating intense competition for these pieces among collectors and dealers.

Macroeconomic factors have dramatically influenced Submariner demand patterns over recent years. The COVID-19 pandemic redirected luxury spending from experiences to tangible goods, with watches benefiting significantly from this reallocation. Cryptocurrency and stock market booms in 2020-2021 created substantial new wealth among younger demographics, who viewed luxury watches as both status symbols and alternative investments.

Celebrity and cultural influence continues to drive Submariner desirability. The model’s association with James Bond across seven films (1962-1989) created enduring cultural cachet that transcends traditional watch collecting. Contemporary celebrities including David Beckham, Brad Pitt, and Mark Wahlberg regularly showcase Submariner models, maintaining the watch’s visibility among affluent younger demographics.

The rise of social media and influencer culture has amplified these celebrity effects. Instagram posts featuring Submariner models regularly generate hundreds of thousands of views, creating aspirational demand that extends far beyond traditional watch collecting circles. This democratization of luxury watch culture has created new demand sources that traditional supply chains struggle to accommodate.

Investment psychology now significantly influences Submariner purchases, with many buyers viewing these watches as alternative assets rather than purely functional timepieces. Recent studies indicate Submariner models have generated average annual returns of 24%, outperforming many traditional investment categories. This investment demand creates additional upward pressure on pricing, as buyers become less price-sensitive when viewing purchases as portfolio allocations rather than consumption expenditures.

Secondary market speculation has created additional premium layers. Professional dealers and flippers purchase popular models specifically for resale, removing inventory from end-user markets and amplifying scarcity effects. Rolex has attempted to combat this through dealer allocation policies prioritizing genuine collectors, but these measures have had limited impact on overall market dynamics.

Conclusion & Collector Takeaways

The contemporary Rolex Submariner market presents a complex landscape where MSRP serves merely as an anchor point rather than a reliable pricing guide. Our analysis reveals several critical insights for collectors, investors, and enthusiasts navigating this sophisticated marketplace.

Steel Submariner dominance emerges as the most significant trend in current markets. Models like the 126610LN and 124060 consistently command 35-36% premiums above MSRP, reflecting their unique position as accessible luxury goods with genuine scarcity value. These premiums appear sustainable given persistent supply constraints and broad demographic appeal, making steel variants the preferred choice for both novice collectors and seasoned investors.

Discontinued model premiums offer particular opportunity for knowledgeable collectors. The 116610LV “Hulk” exemplifies how discontinuation can create substantial appreciation, with current market values 80% above original MSRP. However, these premiums require careful timing and market understanding, as demonstrated by the Hulk’s dramatic price volatility between 2020-2024.

Precious metal variants present value opportunities for collectors willing to accept different risk-return profiles. Current discounts of 13-28% below MSRP for gold models may represent compelling entry points for buyers prioritizing material value over pure investment returns. These models also offer superior availability, with many accessible without extended wait times.

Regional arbitrage opportunities exist for sophisticated international buyers, though currency fluctuations and import costs require careful analysis. European markets often offer better availability and smaller premiums, though Brexit and tax considerations complicate cross-border transactions.

The data overwhelmingly suggests that successful Submariner collecting requires viewing MSRP as a starting point rather than an expected price. Market dynamics, driven by supply constraints, cultural cachet, and investment demand, have created a new pricing reality where understanding secondary market values becomes essential for informed decision-making.

For prospective buyers, patience and relationship-building with authorized dealers remain valuable strategies, though secondary market purchases may offer faster access at predictable premiums. The key lies in understanding that contemporary Submariner ownership involves paying market prices rather than retail prices, with MSRP serving primarily as a historical reference point in an evolved luxury goods marketplace.

Ready to explore the fascinating world of Submariner collecting? Browse our curated selection of authenticated Rolex Submariner models, from contemporary steel sports watches to rare vintage references, each representing a unique opportunity in today’s dynamic market landscape.