Rolex pricing in 2025 reflects unprecedented market dynamics shaped by dual price increases, evolving secondary market conditions, and significant tariff implications. The Swiss manufacturer implemented two distinct price hikes this year—a modest January adjustment followed by a more substantial May increase—while collectors and investors navigate increasingly complex market forces that have redefined luxury watch valuations.

Overview of 2025 MSRP Updates

Rolex’s 2025 pricing strategy unfolded in two distinct phases, marking an unusual departure from the brand’s typical annual adjustment pattern. The January increases proved relatively modest for steel models, with basic Submariner references rising by approximately 1%, translating to roughly $100 increases for entry-level sport watches. However, two-tone configurations experienced more significant adjustments of 5-9%, while full gold models faced the steepest hikes of 7% or more.

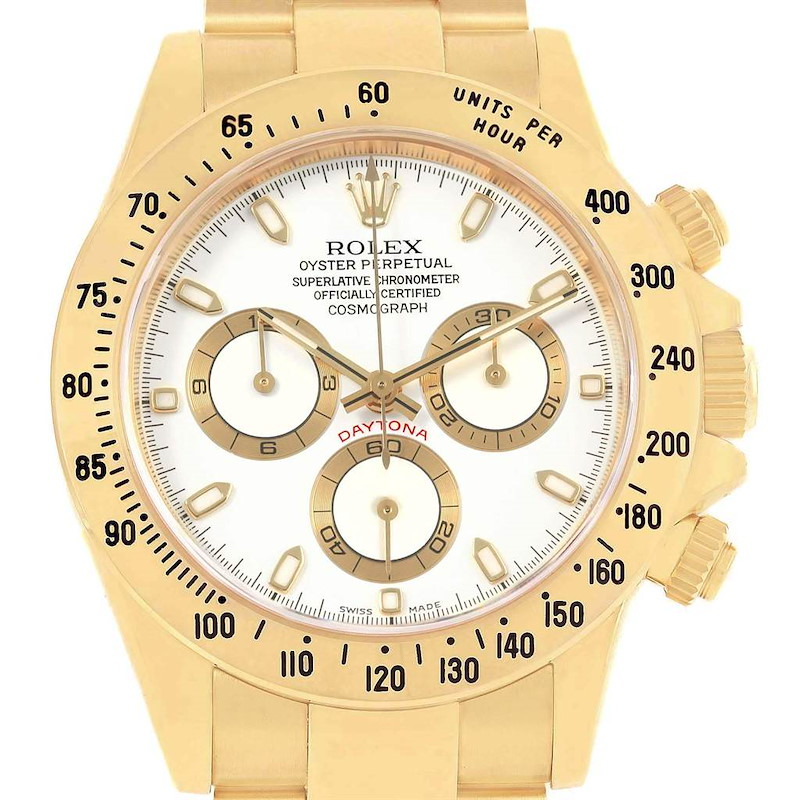

The Daytona collection received particularly aggressive treatment, furthermore, with gold chronographs climbing as much as $7,500 in a single adjustment. Yellow gold Daytona models specifically witnessed increases of 13.4% to 19%, representing the most dramatic single-year jumps in recent memory. This pricing escalation reflects Rolex’s strategic positioning of the Daytona as their most coveted and deliberately scarce offering.

Moreover, the May price adjustment added an additional 3% increase across virtually all references, driven primarily by tariff concerns and rising gold commodity prices. Therefore, steel models that began 2024 at approximately $9,100 for a basic Submariner now command $9,500 at retail. Similarly, the Submariner Date 126610LN progressed from $10,250 to $10,650, marking its first appearance in five-figure territory.

Average Market Prices by Collection

Secondary market pricing reveals significant disparities between retail and actual transaction values across Rolex’s core collections. Steel Submariner references currently trade between $12,000-$16,500, depending on specific variants and conditions. The GMT-Master II collection demonstrates similar premiums, with steel references averaging $15,000-$18,000 on the pre-owned market.

Datejust models offer more accessible entry points, nevertheless, with steel 36mm references trading around $8,000-$9,500, while 41mm variants command $9,500-$12,500. Two-tone Datejust configurations surprisingly maintain stronger market positioning, often trading closer to or above retail values due to their renewed popularity among collectors.

Gold Daytona models present the most complex pricing landscape. Steel chronographs consistently trade at substantial premiums, with current generation 126500LN references commanding $28,000-$34,000 depending on dial configuration. The iconic “Panda” dial variant typically attracts the highest premiums, often reaching $34,000 for mint condition examples.

Day-Date references in precious metals demonstrate remarkable price stability, with yellow gold 40mm models trading around $43,000, closely aligned with their elevated retail pricing. Platinum variants, however, command significant premiums, particularly those featuring diamond-set configurations or rare dial options.

Notable Reference Price Spots

Several specific references serve as market bellwethers for broader Rolex pricing trends. The Submariner Date 126610LN represents the quintessential modern Rolex, currently retailing at $10,650 while commanding approximately $14,000 in secondary transactions. This $3,350 premium reflects sustained demand outpacing authorized dealer allocation.

The GMT-Master II “Batman” reference 126710BLNR maintains substantial market premiums, trading around $16,000-$18,000 despite its $11,100 retail price. Its ceramic bezel technology and iconic colorway contribute to consistent collector interest. Additionally, the “Batgirl” variant on Jubilee bracelet commands similar premiums due to comparable demand dynamics.

Recent Daytona references demonstrate the most dramatic pricing disparities. The steel 126500LN trades at nearly double its $15,500 retail price, with black dial versions reaching $28,000 and white “Panda” configurations approaching $34,000. These premiums reflect Rolex’s deliberate production constraints and the model’s motorsport heritage appeal.

Vintage references continue commanding exceptional values, with the Day-Date 18038 representing accessible precious metal entry points around $15,000-$18,000 for well-maintained examples. However, condition and provenance significantly impact valuations in the vintage segment.

Pre-Owned Comparison Analysis

The pre-owned Rolex market reveals fascinating pricing dynamics across different eras and references. The discontinued Submariner “Hulk” 116610LV currently trades between $16,000-$17,500, representing a significant correction from its 2022 peak of approximately $32,000. This normalization reflects broader market cooling and increased availability as initial speculation subsided.

Vintage “Red Sub” 1680 references demonstrate extraordinary collector appeal, with prices ranging from $17,550 for standard examples to $56,500 for complete sets with original documentation. The distinctive red “Submariner” text and proven collectibility drive these premiums. Moreover, tropical dials and rare variations can command significantly higher valuations.

The legendary “Big Crown” Submariner 6538 represents the pinnacle of vintage collecting, with exceptional examples reaching six-figure valuations. Recent auction results exceeded $1 million for rare configurations, establishing new benchmarks for Submariner collectibility. These prices reflect the model’s James Bond association and extreme rarity in original condition.

Neo-vintage references from the 1980s-2000s offer more accessible vintage entry points. The Submariner 16610LN typically trades around $8,800, while the “Kermit” 16610LV commands approximately $13,750. These models combine vintage appeal with modern reliability, attracting both collectors and daily wearers.

Long-Term Market Index Performance

The WatchCharts Rolex Market Index provides comprehensive insight into brand performance over extended periods. Over the past five years, the index demonstrates approximately 13.6% growth, though recent performance shows more subdued gains. This measured appreciation reflects market maturation following the speculative peaks of 2021-2022.

Recent market analysis indicates a 2.1% decline over the past year, with individual collections showing varied performance. Steel sport models generally maintain stronger resilience compared to precious metal variants, which experienced more significant corrections following commodity price fluctuations and reduced speculative interest.

The index methodology weights popular references by transaction volume, therefore providing realistic market representation. Daytona references command the highest index weighting at $51,197 average pricing, followed by GMT-Master models at $39,506. This weighting reflects both transaction frequency and absolute pricing levels across the secondary market.

Long-term collectors benefit from historical perspective, recognizing that current pricing levels, while elevated compared to pre-2020 valuations, represent normalization rather than decline. Furthermore, Rolex’s production expansion plans suggest future supply increases may moderate premium levels for currently constrained references.

Tariff and Macroeconomic Impact

The implementation of 39% tariffs on Swiss imports fundamentally altered the US luxury watch landscape. These tariffs, effective August 2025, represent a dramatic escalation from the previous 10% baseline rate. Industry analysts predict retail price increases of 12-14% if brands pass full costs to consumers.

Rolex’s preemptive May price adjustment of 3% appears strategically positioned to absorb partial tariff impact. However, additional increases remain likely as import costs fully materialize. The tariff structure particularly affects new inventory, potentially creating pricing advantages for pre-owned stock.

Furthermore, authorized dealer margins decreased by 1% to 33%, reflecting Rolex’s response to cost pressures. This margin compression may influence dealer allocation strategies and customer relationship management. Moreover, the tariff timeline created inventory rushes as retailers imported stock before implementation.

Swiss watch manufacturers face difficult strategic choices between absorbing costs or implementing price increases that may reduce demand. The US market’s importance to Swiss brands creates particular pressure, as American sales growth previously offset weakness in other regions.

Most Expensive Modern Rolex Models

The pinnacle of modern Rolex pricing features the Platinum Day-Date 40 with diamonds, commanding approximately $136,200 at retail. This configuration combines 950 platinum construction with diamond-set bezels and dials, representing Rolex’s most luxurious standard production offering. The ice-blue dial specifically signals platinum composition through Rolex’s color-coding convention.

However, the Rainbow Daytona variants reach even more extraordinary heights. The Everose gold 116595RBOW currently trades around $770,000, reflecting both its gem-set complexity and extreme rarity. Earlier variants in yellow and white gold command $350,000-$430,000, depending on specific configurations and market conditions.

Special edition models push boundaries further still. The platinum Daytona 126506, introduced for the model’s 60th anniversary, retails at $79,300 but commands $120,000-$130,000 in secondary markets. Its exhibition caseback and limited availability contribute to substantial premiums.

Recently discovered ultra-rare platinum Daytona variants from the 1990s achieved auction results exceeding $1.6 million. These secret commissions, with only four examples ever produced, represent the extreme apex of Daytona collectibility and demonstrate how rarity transforms even modern references into million-dollar timepieces.

Market Outlook and Investment Considerations

Current market conditions suggest a period of stabilization following years of rapid appreciation. Steel sport models maintain strong demand fundamentals, supported by Rolex’s controlled production and consistent brand positioning. However, speculative premiums have moderated considerably from peak levels.

Precious metal references face headwinds from both commodity price volatility and reduced speculative interest. Gold Daytona models, despite substantial retail increases, trade closer to retail values than steel counterparts. This convergence suggests more rational pricing alignment.

The tariff environment creates both challenges and opportunities. While new watch prices will increase substantially, pre-owned inventory gains relative attractiveness. Collectors may increasingly focus on vintage and neo-vintage references that avoid tariff implications entirely.

Rolex’s long-term production expansion suggests future supply increases may moderate current premium levels. Three new manufacturing facilities planned through 2029 could significantly impact availability for currently constrained references. However, the brand’s careful demand management suggests any supply increases will be measured and strategic.

For potential buyers, current market conditions offer improved accessibility compared to recent years while maintaining strong value retention prospects. The combination of reduced speculation and continued fundamental demand creates opportunities for genuine collectors and enthusiasts entering the market with long-term perspectives.