The luxury watch market has experienced unprecedented volatility over the past five years, with dramatic price swings that have left many questioning whether Rolex investment value lives up to the hype. While social media influencers and grey market dealers tout astronomical returns, the reality of long term ROI luxury watches is far more nuanced than most buyers realize.

This analysis cuts through the speculation to examine real-world data on watch appreciation, hidden ownership costs, and market dynamics that every serious collector should understand before making their next purchase. Whether you’re evaluating Patek vs Rolex for investment or simply wondering do Rolex watches increase in value, the numbers tell a story that’s both more complex and more interesting than the headlines suggest.

ROI Breakdown by Brand & Model

The Holy Trinity’s Performance Reality

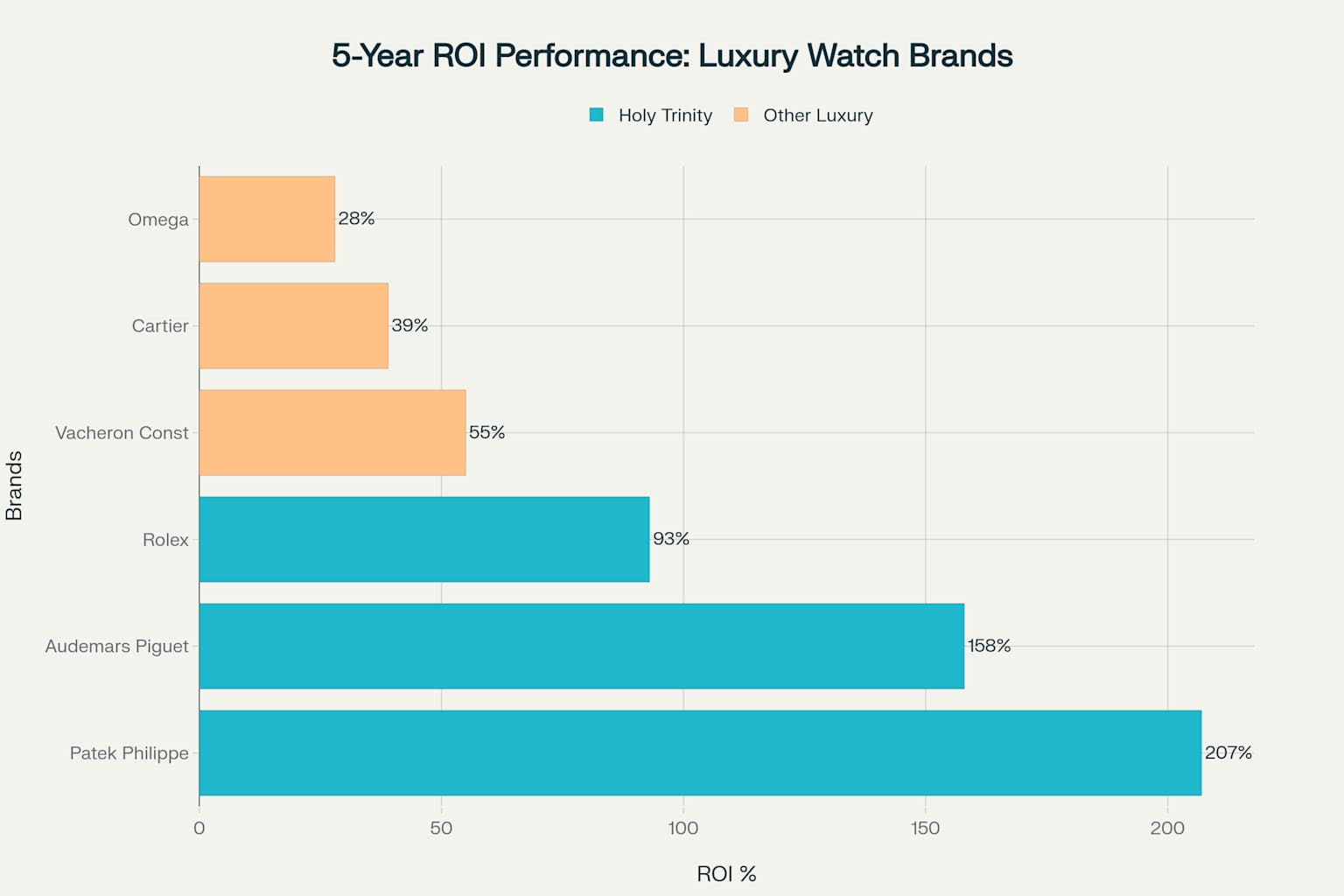

When examining five-year return data from 2019-2024, the performance hierarchy among luxury watch brands reveals significant disparities. Patek Philippe leads with an impressive 207% ROI over five years, followed by Audemars Piguet at 158%, while Rolex delivered a more modest but still substantial 93% return. However, these figures require careful interpretation given the market’s extreme volatility.

Model-by-Model Analysis

Rolex Sports Models:

- Submariner (126610LN): Originally $10,250, currently trading around $18,000 (76% ROI)

- Daytona (116500LN): From $13,150 to approximately $40,000 (204% ROI)

- GMT-Master II: $10,700 to $16,000 (50% ROI)

Patek Philippe Icons:

- Nautilus 5711: The discontinued king, from $32,000 to $150,000 (369% ROI)

- Aquanaut 5167A: $25,000 to $70,000 (180% ROI)

Audemars Piguet:

- Royal Oak 15500: $27,200 to $35,372 (30% ROI, declining trend)

- Royal Oak Chronograph: $38,100 to $48,337 (27% ROI, stable)

Consistency vs. Volatility

The data reveals a critical distinction between hype-driven appreciation and sustainable growth. Rolex models demonstrate more consistent, steady appreciation with lower volatility (3.9% standard deviation) compared to Patek Philippe’s higher returns but greater price swings (3.2% volatility). The Submariner and GMT-Master II represent the most stable investments, rarely trading below retail even during market corrections.

Conversely, the now-discontinued Patek Nautilus 5711 exemplifies speculation-driven pricing. While delivering extraordinary returns, its 369% appreciation reflects artificial scarcity rather than fundamental value, making it unsuitable for risk-averse investors.

The True Cost of Ownership

Hidden Expenses That Erode Returns

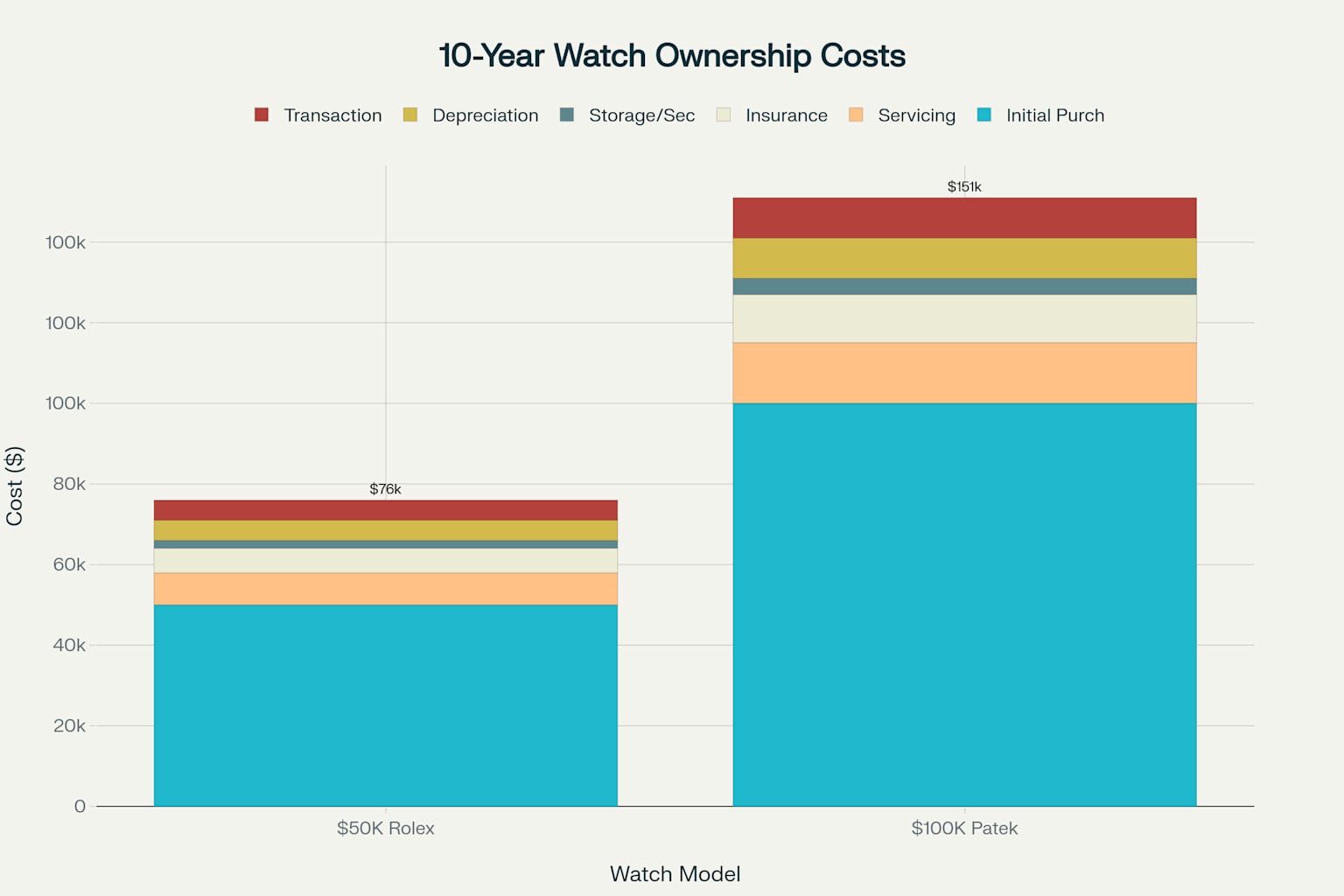

The purchase price represents only the beginning of luxury watch ownership costs. Over a 10-year period, total ownership expenses typically add 50-52% to the initial investment, significantly impacting net returns.

Annual Cost Breakdown

Servicing Costs:

- Rolex: $700-$800 every 5 years

- Patek Philippe: $1,200-$2,500 depending on complications

- Audemars Piguet: $1,000-$2,500 for Royal Oak models

Insurance:

Annual premiums typically range from 1-2% of the watch’s current market value. For a $50,000 Rolex, expect $500-$1,000 annually in insurance costs.

Storage and Security:

Professional storage solutions, safes, and security measures add $200-$400 annually for serious collectors.

The Reality Check

A $50,000 Rolex purchased today will cost approximately $76,000 over 10 years when factoring in all ownership expenses. This 52% cost premium means the watch must appreciate by more than half its purchase price just to break even—a sobering reality rarely discussed in investment circles.

Value Over Time: 5-Year vs 10-Year Horizon

Long-Term Appreciation Patterns

Historical data suggests that luxury watch appreciation follows a compound annual growth rate (CAGR) that moderates over time. Five-year periods often show explosive growth (average 19.0% CAGR for top models), while 10-year horizons typically settle into more sustainable 12.6% annual returns.

Market Performance vs Traditional Assets

The watch market’s relationship with traditional investments reveals both opportunities and risks. From 2020-2024, luxury watches experienced a dramatic 175-point peak in late 2021 before correcting 51% by 2024. This volatility significantly exceeded that of the S&P 500 (7.1% standard deviation) and gold (4.0% volatility).

Why Watches Aren’t Stocks

Unlike equities, watches provide intrinsic utility and emotional satisfaction during ownership. A Rolex Submariner generates daily enjoyment for its wearer while potentially appreciating—a combination impossible with traditional financial instruments. However, this dual-purpose nature also means worn watches command lower premiums than pristine “investment grade” pieces.

The luxury watch market’s low correlation with traditional assets (correlation coefficient of approximately 0.3 with stocks) makes it valuable for portfolio diversification, despite higher volatility.

Why You Shouldn’t Buy Just to Flip

The Speculation Trap

The 2020-2022 market bubble attracted numerous speculators seeking quick profits, fundamentally distorting pricing mechanisms. These “flippers” contributed to artificial scarcity and inflated secondary market prices that ultimately proved unsustainable.

Dealer Relationship Realities

Authorized dealers increasingly scrutinize buyers to prevent flipping, making it harder for speculators to acquire coveted models. Building genuine relationships requires:

- Purchase history across multiple categories

- Demonstrated collecting interest beyond investment potential

- Long-term commitment to the brand relationship

Market Timing Risks

The post-2022 correction demonstrates the danger of market timing. Daytona prices fell from $45,000 peaks to current $40,000 levels, while Nautilus values dropped from $180,000 to approximately $150,000. Speculators who bought at peak prices faced immediate 20-30% losses.

Transaction Costs

Buying and selling watches incurs significant friction costs:

- Dealer premiums: 10-20% above wholesale

- Authentication fees: $200-$500 per transaction

- Insurance and shipping: $100-$300

- Opportunity cost: Time and effort required

What Really Matters: Story vs Price

The Collector’s Mindset

Successful long-term watch investors share a common philosophy: “Buy what you love, understand what it’s worth.” This approach protects against market volatility while ensuring ownership satisfaction regardless of price fluctuations.

Intangible Value Creation

Beyond financial returns, luxury watches provide:

- Heritage connection to horological tradition

- Craftsmanship appreciation through daily interaction

- Social signaling within collector communities

- Generational legacy as heirloom pieces

The 10-Year Test

Before purchasing any luxury watch, ask yourself: “Would I be happy owning this piece if it never appreciated in value?” If the answer is no, reconsider the purchase. The most successful collectors view appreciation as a bonus rather than the primary motivation.

Design and Innovation Premiums

Watches with genuine horological significance—such as the first ceramic Submariner or innovative complications—tend to outperform purely cosmetic variations. Understanding these technical distinctions separates serious collectors from casual buyers.

Market Outlook and Smart Strategies

Current Market Conditions

As of 2025, the luxury watch market shows signs of stabilization after three years of decline. Price decreases have moderated to 0.4% quarterly (Q1 2025), the smallest decline since 2022. This stabilization creates opportunities for patient buyers.

Value Opportunities

Current market conditions favor:

- Two-tone models: Often trading closer to retail than steel sports watches

- Vintage pieces: Less affected by contemporary market speculation

- Complicated movements: Annual calendars and GMT functions showing resilience

Investment-Grade Criteria

Focus on watches that demonstrate:

- Production discontinuation or limited availability

- Technical innovation or horological significance

- Brand heritage and cultural relevance

- Condition excellence with complete documentation

The luxury watch market’s complexity demands a sophisticated approach that balances financial and emotional considerations. While certain models have delivered exceptional returns, sustainable success requires understanding the true costs, market dynamics, and personal motivations driving your collecting decisions.

Watches aren’t stocks — and that’s the point. Invest in time the smart way.