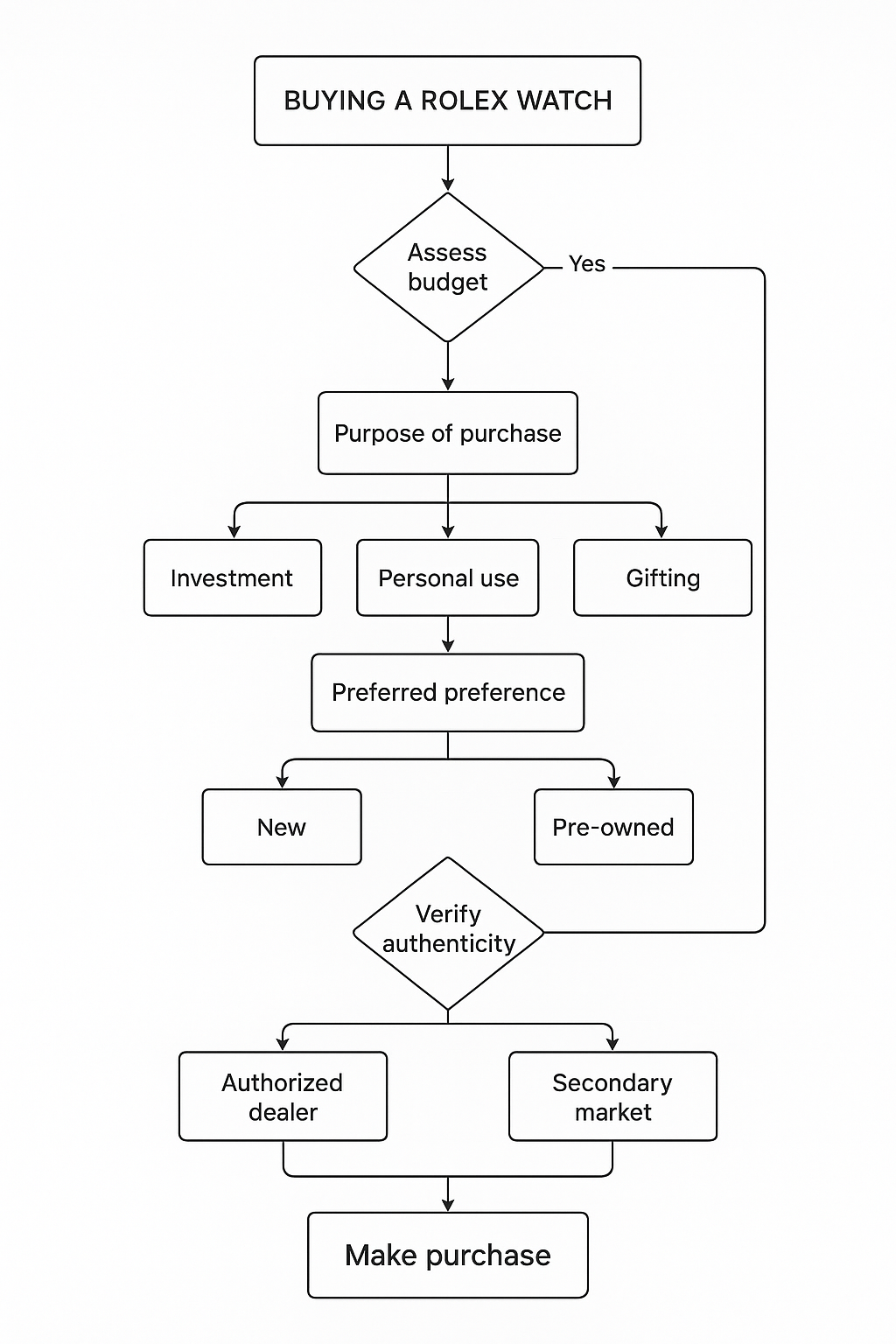

The luxury watch market has experienced dramatic shifts over the past decade, with Rolex watches emerging as both status symbols and alternative investments. The choice between purchasing a new or pre-owned Rolex involves complex considerations spanning immediate availability, long-term value retention, and investment potential. Current market data reveals significant premiums in the secondary market, with popular models like the stainless steel Daytona trading at 132% above retail price, while the Submariner commands approximately 30-50% above MSRP. This comprehensive analysis examines pricing dynamics, appreciation trends, authentication protocols, and strategic buying approaches to help collectors and investors make informed decisions in an evolving marketplace where waiting lists extend 6-60 months for coveted models at authorized dealers.

Table of Contents

TogglePrice Differences Over Time

MSRP Evolution and Market Premiums

Rolex has implemented consistent annual price increases, with 2025 seeing an average rise of 4.8% across all collections, though steel models experienced more modest increases between 1-1.5% while gold watches surged up to 14%. The Submariner’s retail price has increased from $7,500 in 2015 to $10,650 in 2025, representing a 42% MSRP appreciation over the decade. However, secondary market prices tell a different story, with the same Submariner trading at $17,300 in 2025—62% above current retail pricing.

The GMT-Master II demonstrates even more dramatic market dynamics, with MSRP rising from $8,400 to $11,100 over ten years while secondary market values reached $20,600—an 86% premium over retail. This pricing disparity reflects fundamental supply-demand imbalances, where Rolex’s annual production of approximately 1.25 million watches cannot meet global demand for specific references.

Model Scarcity and Year of Release Impact

Production constraints create artificial scarcity for steel sports models, with the Daytona exhibiting the most extreme pricing dynamics. While MSRP has increased modestly from $12,400 to $15,650 over the past decade, market prices peaked at $54,000 in 2022 before stabilizing around $38,000 in 2025. This 143% premium above retail demonstrates how scarcity drives speculative behavior in luxury watch markets.

Vintage and discontinued references command additional premiums based on historical significance and production rarity. The GMT-Master reference 1675 has achieved 325% appreciation since 2010, while certain “Paul Newman” Daytona variants regularly exceed $250,000 at auction. These extreme valuations reflect collector sentiment that transcends traditional luxury goods pricing.

Currency and Geographic Variations

Regional pricing disparities create arbitrage opportunities for informed buyers. Rolex treats US dollars and Swiss francs as reserve currencies, making these markets less susceptible to frequent price adjustments. European markets often experience higher increases when local currencies weaken against the Swiss franc, while Asian markets may offer competitive pricing during currency fluctuations.

The grey market exploits these geographic variations, with dealers sourcing inventory from multiple international markets to optimize profit margins. This global sourcing explains how grey market dealers maintain inventory despite supply constraints at individual authorized dealers.

Depreciation and Appreciation Trends

Models That Appreciate vs Depreciate

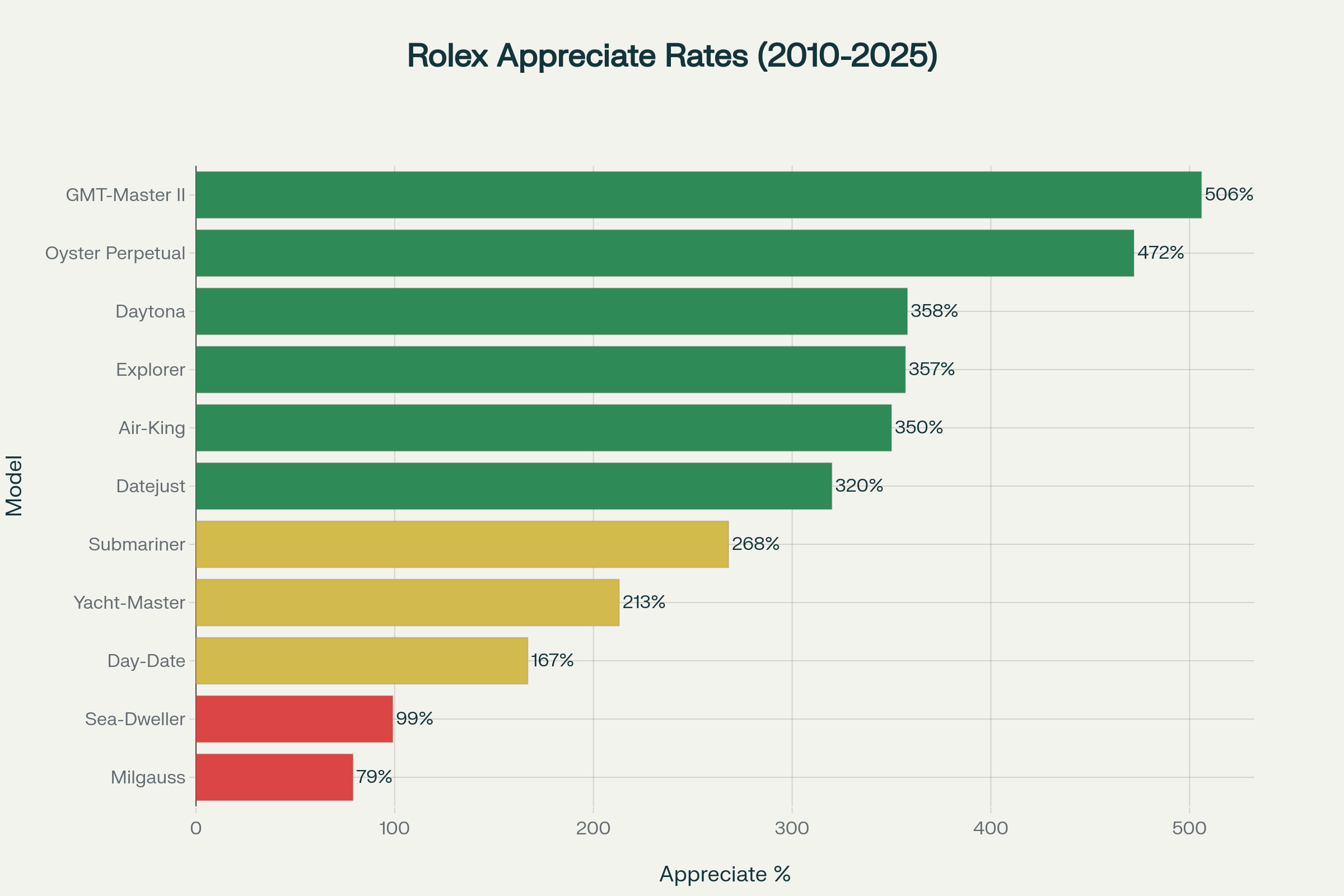

GMT-Master II leads all Rolex collections in appreciation, delivering 506% returns since 2010 according to comprehensive market data from major resellers. This exceptional performance stems from the model’s pilot watch heritage, distinctive bezels like “Pepsi” and “Batman” configurations, and consistent collector demand across vintage and modern references.

Sports models dominate appreciation rankings, with the Daytona achieving 358% appreciation, Explorer 357%, and Air-King 350%. The Oyster Perpetual, traditionally viewed as Rolex’s entry-level offering, surprised markets with 472% appreciation as vibrant dial colors and modern sizing attracted younger collectors.

Depreciation Patterns and Market Corrections

New Rolex purchases typically experience 15-25% depreciation within the first two years as the “new” premium evaporates, similar to luxury automobiles. However, this initial depreciation affects different models unevenly—steel sports models often maintain or exceed retail pricing immediately, while precious metal dress watches may trade below MSRP during their first years.

The 2022-2023 market correction demonstrated varying resilience across models. The Submariner declined from peak pricing of $18,889 to $13,602 before recovering to current $17,295 levels, maintaining 92% of peak value. Conversely, the Daytona experienced more volatility, falling from $53,911 to $27,642 before stabilizing around $37,995.

Investment Performance Analysis

Steel sports models outperformed precious metal variants by approximately 12% year-over-year in 2024, supported by institutional research from Morgan Stanley’s Alternative Asset Division. This performance differential reflects collector preferences for tool watches over dress pieces, particularly among younger demographics entering luxury watch collecting.

Vintage references from the 1960s achieved 45% five-year annualized returns compared to 30% for modern productions, highlighting the premium collectors assign to historical significance and provenance. Models with documented celebrity ownership, racing heritage, or limited production runs command additional premiums that often appreciate faster than broader market indices.

Condition and Authenticity Checks

Physical Inspection Protocols

Case condition assessment requires systematic examination of lugs, crown guards, and case edges for signs of over-polishing or refinishing. Original Rolex cases exhibit sharp, defined edges and proper lug thickness—over-polishing reduces these dimensions and significantly impacts value. Professional collectors examine case flanks under magnification to identify tool marks or uneven surfaces indicating extensive refinishing.

Comparison of a real vs fake Rolex Datejust watch, highlighting differences in crown logos, dial details, and numeral precision for authenticity verification.

Bracelet evaluation focuses on stretch and wear patterns that develop through extended use. Genuine Rolex bracelets exhibit specific wear characteristics, with center links showing polish wear while outer links maintain brushed finishes. Excessive bracelet stretch, measured by lifting the watch horizontally by its case, indicates heavy wear and potential costly replacement needs.

Dial authenticity verification encompasses multiple elements including font precision, marker alignment, and lume consistency. Rolex dials demonstrate exceptional manufacturing precision with zero tolerance for misalignment or printing defects. The cyclops lens must provide 2.5x magnification of the date and exhibit perfect clarity and positioning.

Serial Number and Documentation Verification

Serial number authentication involves cross-referencing engraved case numbers with Rolex production records and guarantee card information. Post-2007 models feature serial numbers on the rehaut at six o’clock, while earlier references display numbers between the lugs. Counterfeiters often reuse serial numbers across multiple fake watches, making verification against Rolex databases essential.

Service history documentation provides crucial condition insights beyond external appearance. Rolex service cards document movement servicing, part replacements, and timing regulation performed by authorized service centers. Unserviced movements can require expensive overhauls as dried lubricants cause accelerated wear and timing degradation.

Original paperwork significantly enhances value by 10-30% compared to watch-only sales, with guarantee cards, sales receipts, and service records providing complete provenance documentation. However, Rolex will not reissue guarantee cards under any circumstances, making authentic documentation irreplaceable for maximum value retention.

Authentication Technologies and Expert Services

Professional authentication services utilize specialized equipment including case-back removal tools, movement photography, and timing analysis to verify authenticity. Rolex Service Centers offer authentication services for approximately $100, providing service guarantee cards for verified genuine watches without original paperwork.

Advanced counterfeit detection requires expertise in movement finishing, component materials, and assembly techniques that distinguish genuine Rolex manufacturing from replica production. Modern counterfeits achieve surprising quality levels, making professional authentication increasingly important for significant purchases.

Buying Channels and Risks

Authorized Dealers: Benefits and Limitations

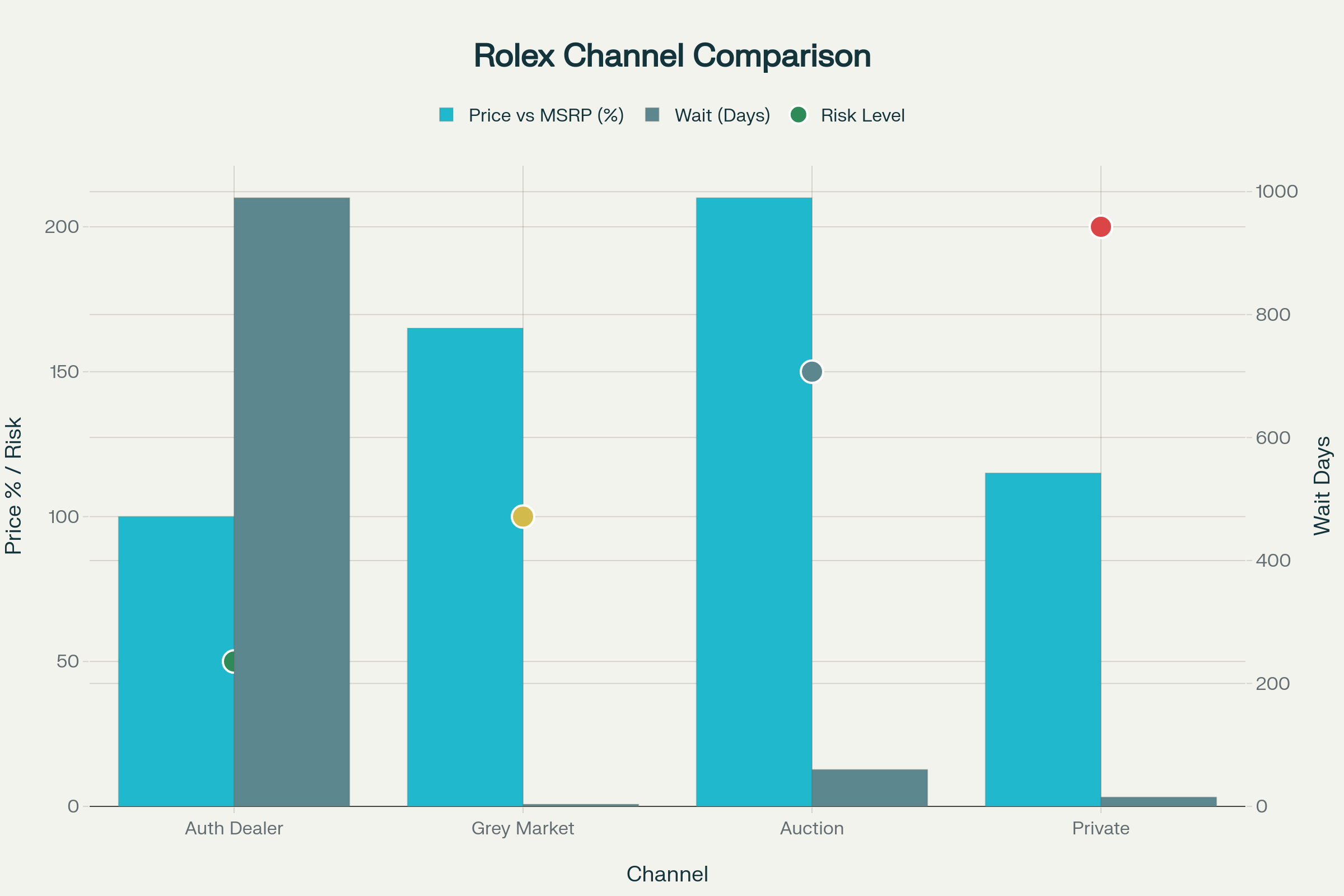

Authorized dealers provide unparalleled authenticity assurance with full warranty coverage, service support, and relationship benefits for established customers. However, waiting lists for popular models extend 6-60 months with no guarantees, while allocation systems favor customers with significant purchase history. Steel sports models often require VIP status or substantial dealer relationships to access.

Authorized dealer pricing remains fixed at MSRP without negotiation flexibility, as contractual agreements prevent price adjustments. This pricing structure creates opportunity costs when secondary market values exceed retail significantly, though authorized purchases provide five-year warranty coverage and genuine factory service.

Grey Market Dealers: Access and Premiums

Grey market dealers offer immediate availability with extensive inventory sourced globally from authorized dealers, parallel imports, and collector sales. These operations typically charge 30-100% premiums above MSRP depending on model scarcity and market conditions. Professional grey market operations provide authentication services and limited warranties, though coverage varies significantly between dealers.

Sourcing practices involve purchasing allocation from authorized dealers who receive watches they cannot immediately sell at retail. This symbiotic relationship allows authorized dealers to move slower-selling inventory while providing grey market dealers access to coveted references for premium pricing.

Auction Houses: Rare Pieces and Market Transparency

Auction environments provide access to rare vintage pieces and documented provenance for historically significant watches. Major auction houses like Christie’s and Phillips offer expert cataloging, condition assessments, and transparent bidding processes that establish market values for exceptional pieces. Auction premiums typically add 20-25% to hammer prices, while buyer’s premiums increase total acquisition costs.

Condition risks require careful evaluation as auction lots may have restoration, replacement parts, or undisclosed service needs that affect long-term value. Auction environments also create competitive bidding scenarios that can drive prices beyond rational market levels, particularly for emotionally charged lots.

Private Sellers: Direct Transactions and Authentication Challenges

Private sales offer potential cost advantages with sellers avoiding dealer margins and transaction fees. However, authentication risks increase significantly without professional dealer verification or return policies. Private transactions require extensive due diligence including movement photography, service documentation review, and independent authentication.

Legal recourse remains limited in private transactions, making thorough pre-purchase inspection essential. Payment security through escrow services helps protect buyers, while professional inspection services can verify authenticity and condition before transaction completion.

Long-Term Ownership Strategy

Investment Goals and Time Horizons

Investment-focused buyers should prioritize steel sports models with documented appreciation potential and strong collector demand. GMT-Master II references offer the highest historical returns at 506% appreciation, while Submariner models provide more stable value retention with lower volatility. Investment strategies should consider 5-10 year holding periods to maximize appreciation potential and minimize short-term market fluctuations.

Collection diversification across model categories reduces concentration risk while providing exposure to different collector segments. Vintage references, modern sports models, and precious metal dress watches each respond differently to market conditions and economic cycles. Portfolio allocation should reflect risk tolerance and collection objectives rather than purely speculative considerations.

Wear Frequency and Lifestyle Considerations

Daily wear requirements favor robust sports models with superior water resistance, shock protection, and service accessibility. Models like the Submariner, GMT-Master II, and Explorer provide professional tool watch reliability while maintaining luxury aesthetics suitable for business environments. Service intervals of 3-5 years align with regular wear patterns and help maintain timing accuracy.

Occasional wear scenarios allow consideration of precious metal models or complicated references that require more careful handling. Day-Date models in gold offer dress watch elegance for formal occasions while maintaining Rolex reliability and service support. Rotation strategies help distribute wear across multiple pieces while preserving individual watch condition.

Style Preferences and Market Positioning

Contemporary design preferences favor larger case sizes and modern materials like ceramic bezels and updated movements. Current production models offer improved reliability, materials science advances, and warranty coverage that vintage pieces cannot match. Technology integration in recent movements provides enhanced power reserves and timing regulation.

Vintage aesthetics appeal to collectors seeking historical authenticity and unique character that modern production cannot replicate. Patina development, period-correct details, and provenance stories create emotional connections that transcend pure investment considerations. Market segments exist for both approaches, with pricing reflecting different collector priorities and preferences.

Conclusion

The choice between new and pre-owned Rolex purchases requires careful analysis of individual circumstances, market conditions, and long-term objectives. Pre-owned options provide immediate access and proven value stability at 20-50% discounts to current grey market pricing, while new purchases offer warranty coverage and pristine condition at the cost of extended waiting periods. Investment potential favors models with established appreciation patterns, particularly GMT-Master II and sports references with documented collector demand. Authentication remains paramount regardless of purchase channel, with professional verification essential for protecting significant investments. Successful Rolex ownership strategies align personal preferences with market realities, considering factors from daily wear requirements to long-term portfolio diversification. The luxury watch market’s evolution suggests continued strong demand for Rolex references across all categories, supporting both investment and collection objectives for informed buyers.