Purchasing a Rolex Daytona represents one of the most challenging yet rewarding decisions in luxury watch collecting. Moreover, this iconic chronograph continues to command unprecedented demand, creating a complex marketplace where buyers must navigate between authorized dealers and secondary market options. Furthermore, understanding the fundamental differences between these purchasing channels will ultimately determine your investment’s success, authenticity guarantee, and overall satisfaction with your timepiece acquisition.

Availability and Wait Times: The Reality of Rolex Allocation

Understanding Authorized Dealer Wait Lists

Authorized dealers operate under Rolex’s strict allocation system, which significantly limits Daytona availability. Consequently, most established dealers maintain waiting lists that extend between 5-10 years for popular steel models. However, these timelines vary considerably based on your purchase history, relationship with the dealer, and specific model preferences.

Additionally, Rolex’s allocation process prioritizes established customers who have purchased multiple pieces previously. Therefore, first-time buyers often face the longest wait times, particularly for the highly coveted steel Daytona with white “Panda” dial. Furthermore, dealers typically receive only 1-3 Daytonas annually, making immediate availability virtually impossible through authorized channels.

Secondary Market: Immediate Gratification at a Premium

In contrast, secondary market dealers offer immediate availability across all Daytona references. Similarly, reputable pre-owned dealers like Bob’s Watches, Crown & Caliber, and Hodinkee Shop maintain extensive inventories of both current and discontinued models. However, this convenience comes at a substantial premium, often ranging from 80-220% above manufacturer’s suggested retail price (MSRP).

Moreover, secondary markets provide access to rare vintage Daytonas and discontinued references unavailable through authorized dealers. Therefore, collectors seeking specific complications, dial variations, or historical significance must inevitably turn to secondary market sources.

Pricing Differences: Understanding Market Dynamics

MSRP vs Market Reality

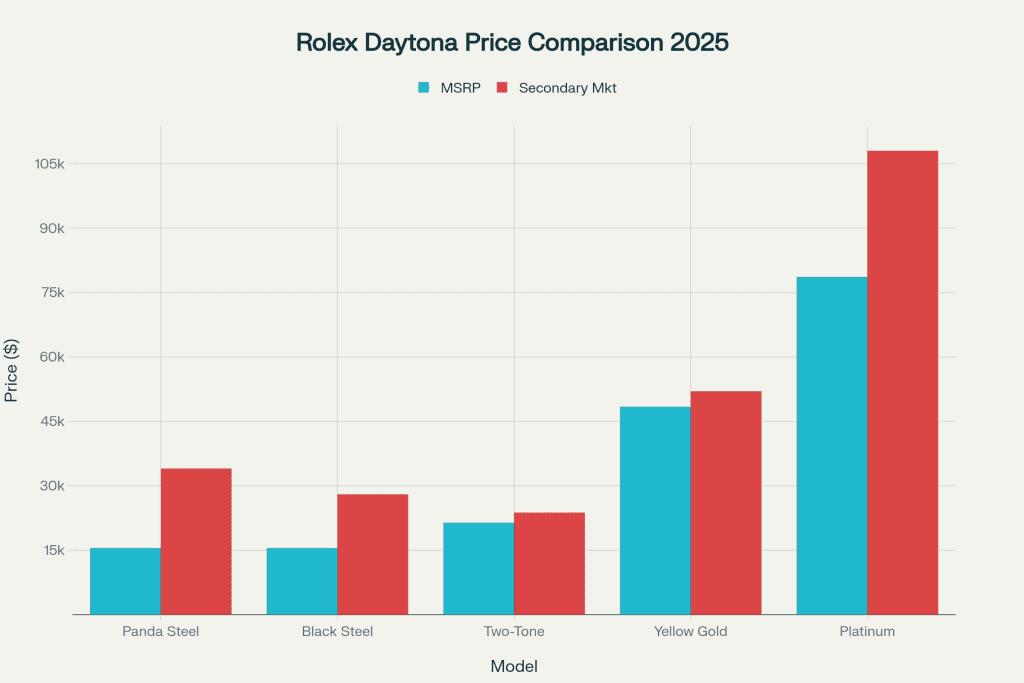

The pricing disparity between authorized dealers and secondary markets reveals the true extent of Daytona demand. Specifically, the current MSRP for a steel Daytona (reference 126500LN) stands at $15,500, while secondary market prices consistently hover around $28,000-$34,000 depending on dial configuration.

Furthermore, precious metal Daytonas show more moderate premiums in the secondary market. For instance, the yellow gold Daytona (reference 126508) retails for $48,400 but trades for approximately $52,000 in the secondary market. Similarly, two-tone models command premiums of only 10-15% above MSRP, making them relatively accessible options for immediate purchase.

Factors Influencing Secondary Market Premiums

Several factors contribute to secondary market price fluctuations. First, dial color significantly impacts pricing, with white “Panda” dials commanding the highest premiums due to their iconic status. Additionally, condition grade, box and papers presence, and seller reputation all influence final transaction prices.

Moreover, market sentiment and celebrity endorsements can create sudden price spikes for specific references. Therefore, timing becomes crucial when purchasing from secondary dealers, as prices fluctuate based on supply availability and collector demand cycles.

Authenticity and Trust: Protecting Your Investment

Authorized Dealer Guarantees

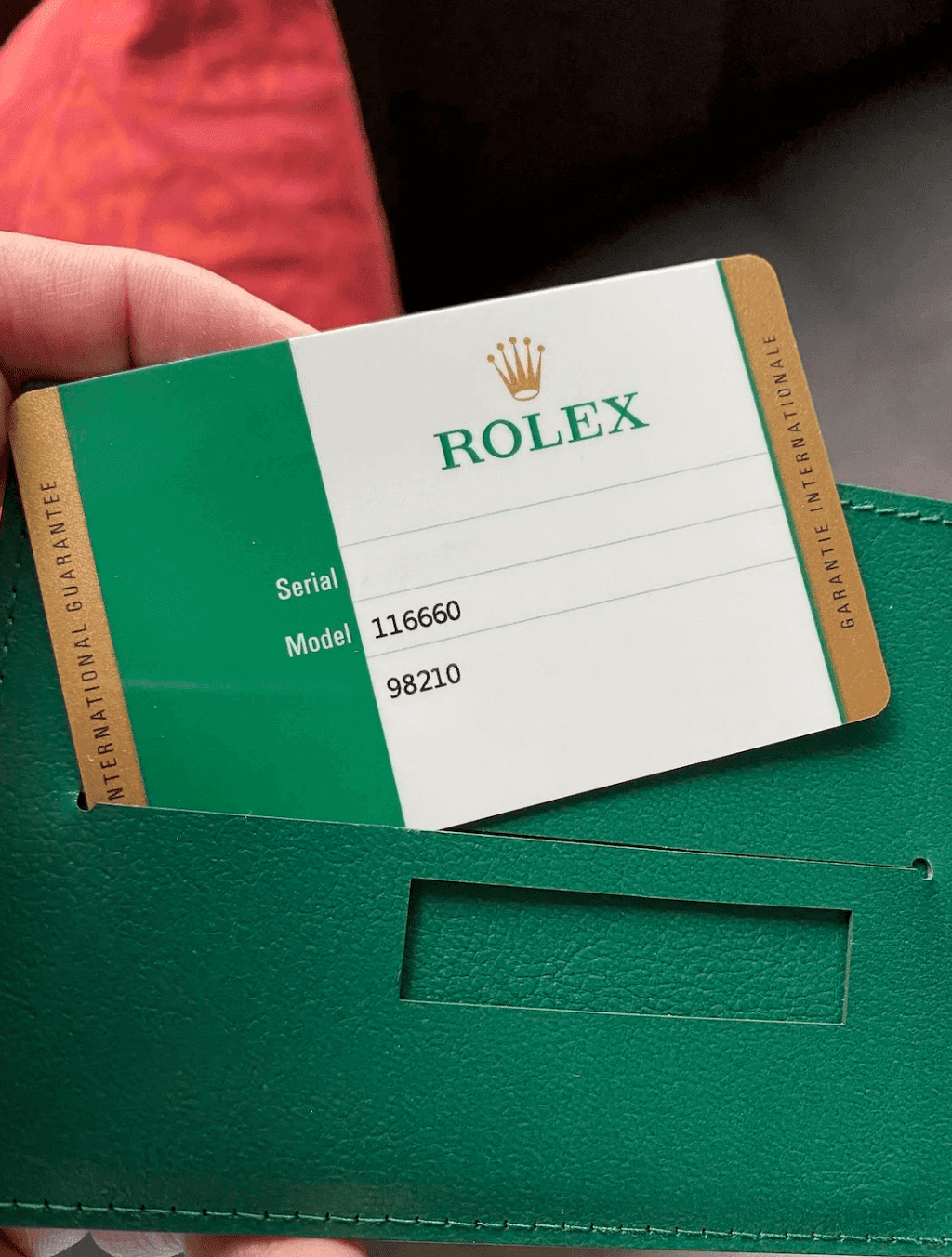

Purchasing from authorized dealers provides unparalleled authenticity assurance and comprehensive warranty coverage. Furthermore, every new Rolex includes a five-year international warranty, complete documentation set, and guaranteed authenticity certification. Additionally, authorized dealers maintain direct relationships with Rolex service centers, ensuring seamless warranty claims and authorized repairs.

However, authorized dealer purchases also establish official ownership records within Rolex’s database. Consequently, this documentation proves invaluable for insurance claims, resale transactions, and service history verification throughout the watch’s lifetime.

Secondary Market Authentication Challenges

Secondary market purchases require significantly more due diligence regarding authenticity verification. Nevertheless, reputable dealers implement rigorous authentication processes using advanced equipment and certified watchmakers. For example, established dealers examine movement components, case construction, dial printing quality, and bracelet specifications to ensure authenticity.

Moreover, buyers should always request comprehensive documentation when purchasing pre-owned Daytonas. Specifically, original papers, warranty cards, and box presence significantly impact both authenticity confidence and resale value. Furthermore, independent authentication services like Authenticity Guarantee provide additional verification layers for high-value transactions.

Condition and Selection: New vs Pre-Owned Considerations

Brand-New from Authorized Dealers

Authorized dealers exclusively offer factory-fresh Daytonas with pristine condition and complete accessory sets. Additionally, new purchases include protective stickers, unworn bracelets, and perfect case finishing that collectors particularly value. However, the extremely limited selection means buyers often cannot choose specific dial colors or reference numbers.

Furthermore, new Daytonas from authorized dealers require immediate decisions when allocation becomes available. Therefore, buyers must often accept whatever model the dealer offers, regardless of personal preferences or desired specifications.

Pre-Owned and Unworn Secondary Market Options

Secondary markets offer extensive condition variety, from mint unworn pieces to well-maintained vintage examples. Similarly, condition grading systems help buyers understand exactly what they’re purchasing, with categories ranging from “new/unworn” to “good” condition. Moreover, experienced collectors often prefer pre-owned pieces that show honest wear, as these watches have proven their reliability and functionality.

Additionally, secondary dealers frequently offer “new old stock” pieces – discontinued references in unworn condition that provide the best of both worlds. Therefore, buyers can acquire rare dial configurations or vintage references while maintaining exceptional condition standards.

Variety and Discontinued Models

The secondary market provides access to Rolex’s complete Daytona history, including discontinued references and special editions. For instance, collectors can find vintage Daytonas with exotic dials, different case sizes, and unique complications unavailable in current production. Furthermore, this extensive selection allows buyers to choose pieces that perfectly match their aesthetic preferences and collecting goals.

Investment and Resale Potential: Long-Term Value Considerations

Value Retention from Authorized Dealers

Daytonas purchased at MSRP from authorized dealers typically demonstrate exceptional value retention and appreciation potential. Specifically, historical data shows steel Daytonas have maintained consistent premiums above retail pricing for over two decades. Moreover, the combination of authentic provenance, complete documentation, and pristine condition maximizes long-term investment performance.

Furthermore, authorized dealer purchases establish clear ownership chains that future buyers particularly value. Therefore, these pieces often command premium prices when eventually sold, as authenticity concerns remain minimal throughout their ownership lifecycle.

Secondary Market Investment Dynamics

Secondary market purchases present more complex investment scenarios due to higher initial costs. However, rare or discontinued references often appreciate more rapidly than current production models. Additionally, perfectly preserved vintage Daytonas with complete documentation can deliver exceptional returns for knowledgeable collectors.

Moreover, secondary market timing becomes crucial for investment success. Specifically, purchasing during market corrections or immediately after price adjustments can provide excellent entry points for long-term appreciation.

Market Trends Affecting Future Resale

Current market trends suggest continued strong demand for Daytona chronographs across all price segments. Furthermore, Rolex’s limited production strategy ensures supply constraints that traditionally support premium pricing. Additionally, the brand’s expanding global presence and growing collector base provide fundamental demand support for quality pre-owned pieces.

However, buyers should consider potential market saturation in certain references and focus on truly exceptional pieces with strong provenance. Therefore, both authorized dealer and secondary market purchases can deliver excellent investment performance when chosen carefully and held long-term.

Making the Right Choice: Strategic Purchasing Decisions

Ultimately, choosing between authorized dealers and secondary markets depends on individual priorities, timeline flexibility, and investment objectives. Moreover, serious collectors often pursue both channels simultaneously – building relationships with authorized dealers while opportunistically acquiring exceptional secondary market pieces.

Furthermore, first-time Daytona buyers might consider starting with secondary market purchases to gain immediate access while developing authorized dealer relationships for future allocations. Similarly, collectors seeking specific discontinued references have no alternative but secondary market acquisition.

Therefore, successful Daytona ownership requires understanding both markets’ advantages and limitations. Additionally, working with reputable dealers in either channel ensures authenticity, fair pricing, and professional service throughout the purchasing process.

The Rolex Daytona remains one of horology’s most desirable chronographs, regardless of acquisition method. However, informed buyers who understand market dynamics, authentication requirements, and investment considerations will ultimately make decisions that provide decades of satisfaction and value appreciation.