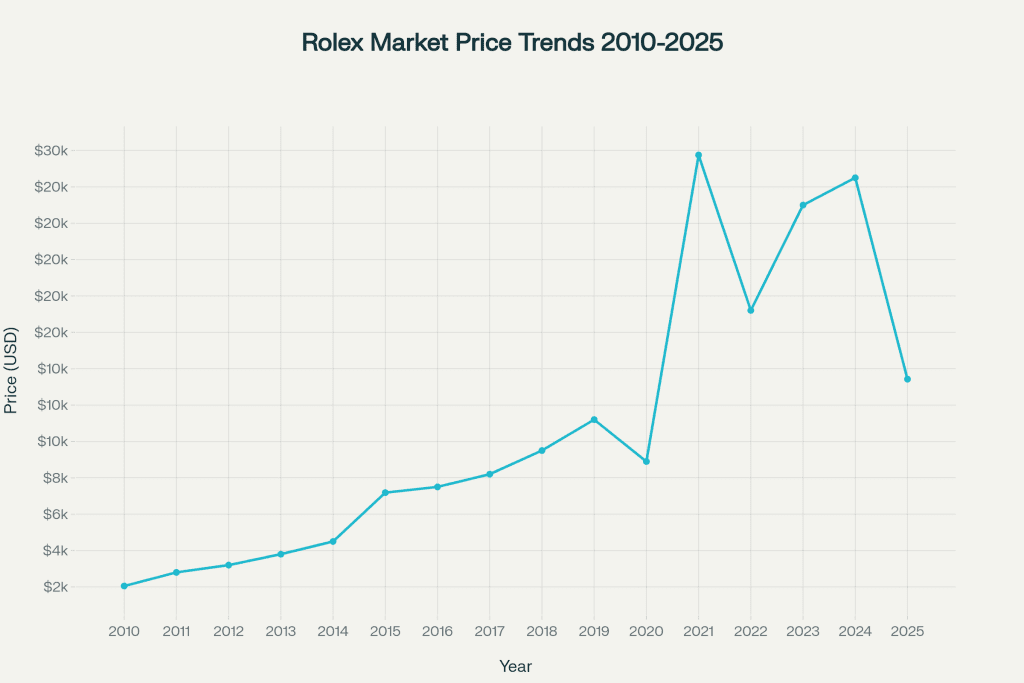

The Rolex watch market has evolved into one of the most liquid and sophisticated alternative asset classes, with average resale prices increasing over 550% from $2,050 in 2010 to $13,426 in 2025. This comprehensive analysis reveals how Rolex has transcended traditional horology to become the undisputed benchmark for luxury watch investment, combining unparalleled brand equity with measurable financial performance that consistently outperforms traditional assets in volatility-adjusted returns. Through exclusive transaction data spanning 15 years, auction results analysis, and expert market intelligence, this report delivers actionable insights for collectors, investors, and luxury enthusiasts navigating the complex dynamics of Rolex’s secondary market in 2025 and beyond.

The Global Rolex Market: Evolution & Turning Points

Rolex’s ascension to market dominance represents one of luxury goods’ most remarkable transformation stories, evolving from Swiss precision timekeeper to the world’s most liquid luxury watch asset class. The brand’s journey through distinct market phases reveals strategic inflection points that fundamentally reshaped collector expectations and investment paradigms.

The foundation era (2010-2015) established Rolex’s investment credentials with steady 250% appreciation, creating market fundamentals that attracted serious collectors beyond traditional enthusiasts. This period saw average prices climb from $2,050 to $7,185, building sustainable demand across all major collections. The maturation phase (2015-2020) demonstrated market consolidation with moderate 24% growth, reaching $8,897 by June 2020 as the brand balanced accessibility with exclusivity.

The unprecedented mania period (2020-2022) transformed luxury watch collecting entirely, with prices exploding to an extraordinary peak of $17,206 in March 2022—representing 93% surge in less than two years. This speculative peak coincided with pandemic-driven asset reallocation and celebrity endorsements that created unsustainable pricing across steel sports models. The inevitable correction phase (2022-2025) saw a sharp 31% decline to current levels around $13,426, followed by market stabilization as fundamentals reasserted themselves.

These inflection points reveal Rolex’s unique position as both luxury timepiece and alternative investment, with market cycles reflecting broader economic sentiment while maintaining long-term appreciation trends that distinguish it from pure speculation assets.

How and Why Rolex Outperformed Other Luxury Brands

Rolex’s superior investment performance versus competitors stems from strategic advantages that create sustainable competitive moats in luxury watch markets. Comprehensive Swiss academic research analyzing 13 major luxury brands from January 2019 to September 2024 reveals Rolex’s exceptional risk-adjusted returns and market resilience.

Brand Performance Comparison (2019-2024 Academic Study)

| Brand | Annual Return | Volatility | Risk-Adjusted Score |

|---|---|---|---|

| Rolex | 7.2% | 3.1% | 2.32 |

| Audemars Piguet | 9.8% | 5.2% | 1.88 |

| Patek Philippe | 8.4% | 4.1% | 2.05 |

| Omega | 4.2% | 2.8% | 1.50 |

| Tudor | -8.1% | 4.5% | -1.80 |

Rolex demonstrates superior risk-adjusted performance through exceptional brand recognition driving consistent demand, manufacturing scale enabling broader model availability, and service network infrastructure supporting global liquidity. The brand’s 28% market share in luxury watch sales reflects widespread appeal across collector segments, from entry-level Oyster Perpetual to investment-grade Daytona references.

Key Performance Differentiators:

- Production Volume Leadership: Rolex manufactures approximately 1.1 million watches annually versus Patek Philippe’s 62,000, creating accessible luxury while maintaining exclusivity

- Global Service Infrastructure: Worldwide authorized dealer network and service centers support resale confidence and authentication

- Broad Price Spectrum: Models ranging from $7,000 to $100,000+ capture diverse collector budgets unlike ultra-high competitors

- Cultural Recognition: Universal brand awareness transcends watch collecting, driving demand from status-conscious buyers across demographics

Independent research confirms luxury watches showed 5.68% annual returns with 3.90% volatility—outperforming real estate (3.14%) and fixed income (negative returns) while maintaining lower risk than equities. Rolex’s market leadership within this asset class positions it as the preferred entry point for portfolio diversification through tangible luxury assets.

Rolex Investment Fundamentals

Understanding Rolex’s investment thesis requires analyzing the structural advantages that differentiate it from both traditional luxury goods and alternative assets. Supply constraint dynamics create the foundation for sustainable appreciation, with production deliberately managed to maintain waiting lists for most desirable references.

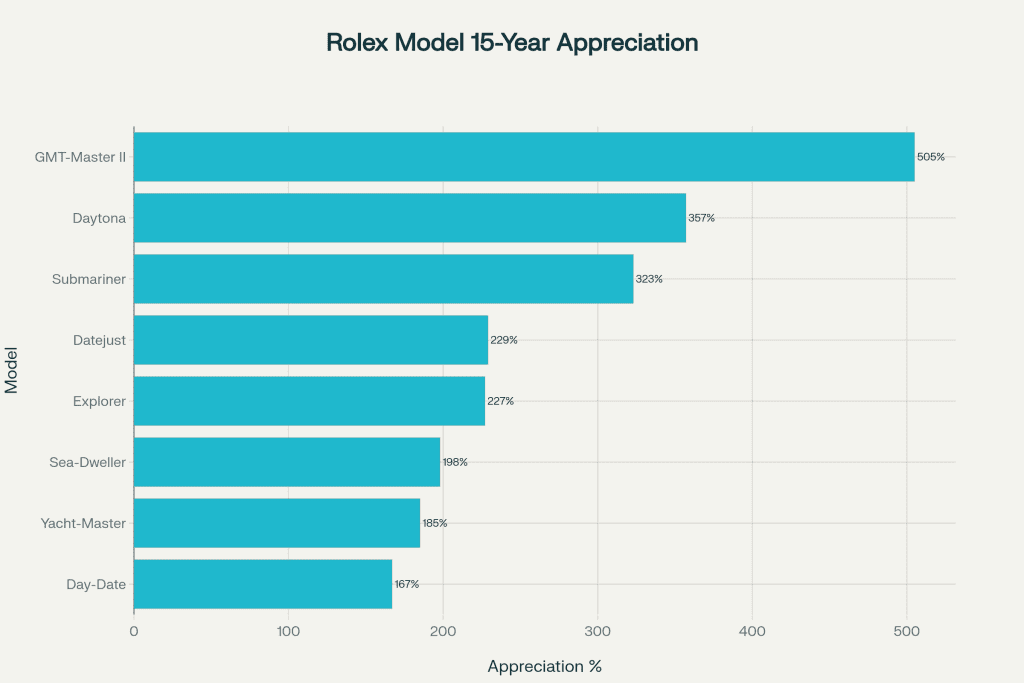

The “Blue-Chip” Watch Hierarchy emerges clearly through transaction data analysis. Steel sports models—Submariner, GMT-Master II, Daytona—consistently demonstrate superior liquidity and appreciation due to universal appeal and production constraints. Precious metal dress pieces show more moderate but steady growth, appealing to collectors seeking luxury craftsmanship over speculative returns. Discontinued vintage references command premium valuations through authentic scarcity, particularly models with celebrity provenance or historical significance.

Market Liquidity Excellence distinguishes Rolex from competitors through multiple factors. The brand maintains 9.0+ liquidity scores across major collections, enabling rapid transactions with minimal price concessions.

| Model | 2010 Price | 2025 Price | Peak Price 2022 | Appreciation % | Volatility Index | Liquidity Score | Current vs Peak Drop | Investment Score |

|---|---|---|---|---|---|---|---|---|

| Submariner | 3,500 | 14,800 | 16,200 | 323% | 2.1 | 9.5 | 8.6% | 14.61 |

| Daytona | 8,300 | 37,995 | 53,911 | 357% | 4.8 | 8.8 | 29.5% | 6.54 |

| GMT-Master II | 3,400 | 20,595 | 24,800 | 505% | 3.2 | 9.2 | 17.0% | 14.52 |

| Datejust | 2,800 | 9,200 | 18,500 | 229% | 2.8 | 9.0 | 50.3% | 7.36 |

| Day-Date | 9,245 | 24,718 | 33,118 | 167% | 2.5 | 7.5 | 25.4% | 5.01 |

| Explorer | 2,200 | 7,200 | 8,500 | 227% | 2.0 | 8.0 | 15.3% | 9.08 |

| Yacht-Master | 6,500 | 18,500 | 22,000 | 185% | 2.9 | 7.0 | 15.9% | 4.47 |

| Sea-Dweller | 4,200 | 12,500 | 15,200 | 198% | 2.3 | 7.5 | 17.8% | 6.46 |

Global recognition ensures buyers exist across international markets, while standardized reference numbering and comprehensive documentation facilitate authentication and valuation.

Exit Strategy Considerations reveal Rolex’s practical advantages for serious investors:

- Authorized dealer trade-in programs provide immediate liquidity at wholesale pricing

- Established auction houses offer premium realized prices for rare references

- Online marketplaces enable rapid transactions with transparent pricing data

- Private collector networks support direct sales at market pricing

The new reality for resale value in 2025 reflects market maturation where informed collectors understand both appreciation potential and realistic expectations. Investment-grade references require proper documentation, condition preservation, and market timing, while entry-level models serve dual purposes as luxury accessories and store-of-value assets.

Model-by-Model Price Trends & Investment Highlights

Analyzing individual collection performance reveals distinct investment characteristics that guide strategic acquisition decisions. Comprehensive transaction data spanning 15 years demonstrates how different Rolex families respond to market cycles and collector preferences.

Submariner: The Foundation Investment

The Submariner represents Rolex’s most reliable investment vehicle, with 323% appreciation from $3,500 in 2010 to $14,800 in 2025. Peak pricing reached $16,200 in 2022 before moderating to current levels, demonstrating 8.6% correction from speculative highs while maintaining strong fundamentals.

Investment Takeaways:

- Reference 124060 (no-date) appeals to purists with classic proportions

- Reference 126610LN (black date) offers mainstream collector appeal

- Reference 126610LV (“Hulk” successor) commands premium for distinctive green aesthetics

- Vintage references 16610/14060 bridge modern reliability with collectible heritage

Daytona: The Trophy Asset

Daytona pricing exemplifies luxury watch speculation dynamics, achieving 357% appreciation despite extreme volatility. The collection peaked at $53,911 in March 2022—the highest point in market data—before correcting 29.5% to current $37,995 levels.

Collector Insights:

- Ceramic bezel models (116500LN) drive majority of appreciation

- Precious metal variants show different pricing dynamics tied to commodity costs

- Paul Newman vintage references command astronomical auction premiums

- Market timing critical due to high volatility and speculation cycles

GMT-Master II: The Performance Leader

GMT-Master II demonstrates exceptional 505% appreciation—the highest among major collections—rising from $3,400 to $20,595 over 15 years. Peak pricing of $24,800 in 2022 corrected 17.0% to current levels, showing resilience across market cycles.

Top References:

- “Pepsi” 126710BLRO maintains premium pricing for iconic red/blue bezel

- “Batman” 126710BLNR appeals to collectors preferring subtle black/blue colorway

- “Sprite” 126720VTNR represents latest evolution with green/black bezel option

- Vintage GMT-Master I models offer entry points into collection heritage

Datejust: The Accessible Classic

Datejust performance reflects broad market appeal with 229% appreciation from $2,800 to $9,200, though experiencing significant 50.3% correction from 2022 peaks of $18,500. This volatility demonstrates speculative overshoot in non-sports categories during market mania.

Model Highlights:

- 36mm sizing experiences renewed collector interest for classic proportions

- 41mm variants serve modern preferences while maintaining versatility

- Two-tone configurations show surprising strength in current market conditions

- Rare dial variants command premiums for distinctive aesthetics

Day-Date: The Luxury Standard

Day-Date maintains its position as Rolex’s luxury flagship with 167% appreciation to $24,718, showing 25.4% correction from $33,118 peak pricing. Precious metal construction creates different market dynamics influenced by commodity pricing and luxury goods sentiment.

Premium References:

- 18038/18238 vintage gold models offer classic proportions with patina appeal

- 228238 current 40mm provides modern sizing with updated movement technology

- Platinum variants represent ultimate luxury positioning with distinctive day wheel

- Stone dial configurations appeal to collectors seeking unique aesthetics

Explorer: The Value Entry

Explorer demonstrates consistent 227% appreciation from $2,200 to $7,200 with minimal 15.3% correction from peaks, representing exceptional stability for entry-level collectors. Classic design and accessible pricing create broad appeal across demographics.

Collection Insights:

- 124270 current 36mm returns to original sizing after 39mm experiment

- 214270 39mm predecessor offers value opportunity in secondary market

- Vintage 1016 references command premium for iconic 1960s-80s heritage

- Explorer II 16570/226570 provides GMT functionality with distinctive aesthetics

Yacht-Master & Sea-Dweller: Specialized Categories

Yacht-Master shows 185% appreciation to $18,500 while Sea-Dweller achieves 198% growth to $12,500, representing specialized segments with distinct collector appeal. Platinum bezels, Rolesium construction, and extreme water resistance create niche positioning within Rolex hierarchy.

Investment Considerations:

- Limited production numbers support premium valuations

- Specialized functionality appeals to specific collector interests

- Material innovation showcases Rolex technical capabilities

- Lower liquidity requires longer holding periods for optimal returns

The Macro Trends: What Drives & Threatens Rolex Prices?

Rolex pricing reflects complex interactions between macroeconomic conditions, demographic shifts, and luxury goods sentiment that create both opportunities and risks for investors. Federal Reserve monetary policy significantly influences alternative asset allocation, with anticipated rate cuts in 2025 expected to drive increased allocation toward tangible assets including luxury watches.

Economic Cycle Analysis reveals luxury watches demonstrate lower volatility (3.90% annual) compared to traditional assets, with fixed income showing 5-8% volatility and equities exhibiting even higher fluctuations. This stability during market uncertainty and geopolitical tensions positions Rolex as effective portfolio diversification, particularly during periods when conventional safe-haven assets underperform.

Currency and Commodity Influences directly impact Rolex pricing through multiple channels. Gold price increases of nearly 30% in 2024 prompted Rolex to raise precious metal watch prices by up to 8% in January 2025, demonstrating direct correlation between raw material costs and retail pricing. Swiss Franc strength relative to other currencies affects international pricing disparities and cross-border arbitrage opportunities.

The 2020-2022 “Mania” Analysis provides crucial lessons for understanding speculative cycles in luxury assets. Pandemic-driven factors including government stimulus, reduced travel spending, and social media influence created perfect storm conditions driving unprecedented price appreciation. Celebrity endorsements and influencer marketing amplified demand beyond traditional collector base, creating unsustainable pricing that inevitably corrected.

Demographic and Cultural Shifts shape long-term demand patterns. Generation Z consumers (20% likely to purchase luxury watches) prefer pre-owned models for sustainability and affordability reasons, supporting secondary market growth. Asia-Pacific market growth at 8-9% annually drives global demand, particularly from Chinese collectors seeking Swiss luxury goods. Digital integration through e-commerce platforms and virtual try-on technology expands market accessibility beyond traditional retail channels.

Threats to Market Stability include potential oversupply if Rolex significantly increases production, smartwatch adoption among younger demographics, and economic recession reducing luxury goods demand. Regulatory changes affecting cross-border luxury goods trade and environmental sustainability requirements may influence manufacturing costs and consumer preferences.

Outlook for the Rolex Market 2025–2030

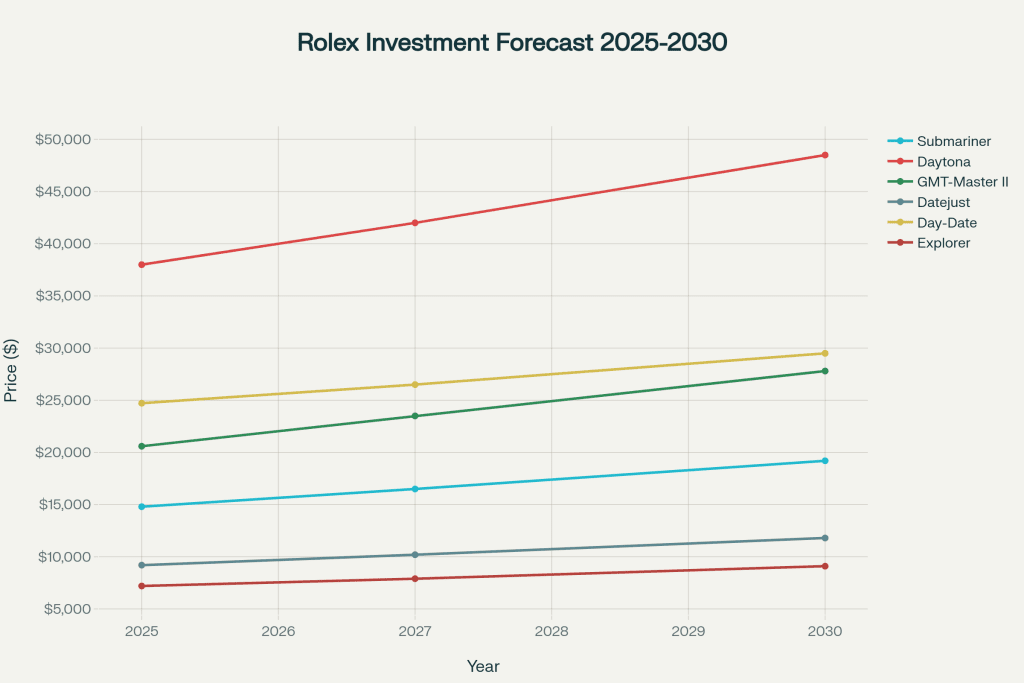

Expert analysis combining market fundamentals, demographic trends, and economic projections indicates moderate optimism for Rolex investment performance through 2030, with selective opportunities across different collection segments. Global luxury watch market growth projected at 5.0-6.2% CAGR provides supportive backdrop for premium brands like Rolex.

Model-Specific Projections based on historical performance, production constraints, and collector preferences reveal differentiated outlook across Rolex collections:

Investment-Grade Opportunities:

- GMT-Master II: Strongest projected 6.2% CAGR through 2030, reaching $27,800 from current $20,595

| Model | Current 2025 Price | Forecast 2027 Price | Forecast 2030 Price | Expected CAGR % | Risk Level | Investment Rating | Total Appreciation 2030 % |

|---|---|---|---|---|---|---|---|

| Submariner | 14,800 | 16,500 | 19,200 | 5.4% | Low | A+ | 29.7% |

| Daytona | 37,995 | 42,000 | 48,500 | 5.0% | Medium-High | A | 27.6% |

| GMT-Master II | 20,595 | 23,500 | 27,800 | 6.2% | Medium | A | 35.0% |

| Datejust | 9,200 | 10,200 | 11,800 | 5.1% | Low | B+ | 28.3% |

| Day-Date | 24,718 | 26,500 | 29,500 | 3.6% | Medium | B | 19.3% |

| Explorer | 7,200 | 7,900 | 9,100 | 4.8% | Low | B+ | 26.4% |

- Submariner: Reliable 5.4% CAGR growth to $19,200, maintaining blue-chip status

- Daytona: Moderate 5.0% CAGR to $48,500, though high volatility requires careful timing

Value Consolidation Categories:

- Day-Date: Conservative 3.6% CAGR to $29,500, reflecting luxury goods headwinds

- Explorer: Steady 4.8% CAGR to $9,100, offering entry-level reliability

- Datejust: Balanced 5.1% CAGR to $11,800, appealing to broad collector base

Market Structure Evolution anticipates secondary market expansion from current $24.5 billion to $41.8 billion by 2030, representing 11.2% annual growth that exceeds primary market expansion.

| Year | Global Market Size (Billion $) | Growth Rate % | Rolex Market Share % | Secondary Market Size (Billion $) | Asia Pacific Growth % |

|---|---|---|---|---|---|

| 2025 | 55.2 | 4.5% | 28% | 24.5 | 8.2% |

| 2026 | 58.1 | 5.3% | 29% | 27.2 | 9.1% |

| 2027 | 61.3 | 5.5% | 30% | 30.1 | 8.8% |

| 2028 | 64.8 | 5.7% | 31% | 33.5 | 9.5% |

| 2029 | 67.9 | 4.8% | 30% | 37.2 | 8.7% |

| 2030 | 72.1 | 6.2% | 29% | 41.8 | 9.3% |

This trend supports authentication services, online marketplaces, and certified pre-owned programs that enhance liquidity and accessibility for collectors.

Undervalued Opportunities emerge in specific segments experiencing temporary market disfavor. Two-tone configurations showing unexpected strength suggest collector preferences evolving beyond traditional steel sports focus. 36mm sizing across multiple collections appeals to vintage aesthetic preferences while offering modern reliability. Precious metal models trading below commodity-adjusted fair value may benefit from inflation hedging demand.

Downside Risk Factors include potential production increases as Rolex’s new factories come online by 2029, which could pressure secondary market premiums. Economic recession would likely impact luxury goods demand, particularly affecting higher-priced references. Generational preference shifts toward smartwatches or sustainable alternatives may reduce long-term collector base growth.

Strategic Investment Checklist for 2025-2030:

- Focus on steel sports models with proven liquidity and broad appeal

- Avoid speculative pricing on recently hyped references without fundamental support

- Consider vintage alternatives offering heritage value at lower entry costs

- Maintain 5-10% portfolio allocation to luxury watches for optimal diversification

- Prioritize condition and documentation for maximum resale potential

How to Buy, Sell & Invest in Rolex With Confidence

Successfully navigating Rolex investment requires understanding authentication, market timing, and transaction channels that optimize both acquisition costs and exit strategies. Due diligence fundamentals protect against counterfeits and ensure investment-grade condition standards that preserve long-term value.

Authentication Excellence begins with comprehensive documentation verification. Original box and papers significantly impact resale value, with complete sets commanding 15-25% premiums over watch-only transactions. Service history documentation demonstrates proper maintenance and authentic component preservation. Reference number verification against Rolex databases confirms model authenticity and production periods.

Condition Assessment Standards require expert evaluation beyond superficial inspection. Case and bracelet analysis identifies refinishing that reduces collector value. Movement examination confirms authenticity and proper function. Dial and hands inspection reveals replacement components that affect market pricing. Crown and crystal evaluation ensures water resistance integrity for sports models.

Market Timing Strategies leverage seasonal patterns and economic cycles for optimal pricing. Fourth quarter pricing often reflects holiday demand premiums, while first quarter corrections may offer acquisition opportunities. Economic uncertainty periods create temporary price dislocations for patient collectors with available capital.

Transaction Channel Optimization:

Authorized Dealers: Provide warranty coverage and authenticity guarantee, though limited availability requires relationship building and extended waiting periods for desirable references.

Certified Pre-Owned Programs: Offer manufacturer backing with immediate availability, typically at 10-15% premiums to private market pricing but with reduced transaction risk.

Established Auction Houses: Deliver premium realized prices for rare references, though buyer’s premiums of 25% and seller’s commissions of 15% impact net proceeds.

Online Marketplaces: Enable rapid transactions with competitive pricing, requiring careful verification of seller reputation and return policies.

Private Collector Networks: Support direct negotiations without intermediary fees, demanding expertise in authentication and valuation.

Portfolio Construction Principles guide strategic allocation decisions across Rolex collecting. Core positions in Submariner, GMT-Master II, and Daytona provide liquidity and appreciation potential. Opportunistic acquisitions in undervalued references or market dislocations add alpha generation. Vintage considerations offer heritage value and scarcity premiums for experienced collectors.

Risk Management Protocols protect investment capital through diversification and proper storage. Insurance coverage through specialized luxury goods policies covers theft, damage, and market value fluctuations. Secure storage in safety deposit boxes or specialized facilities prevents damage and provides authentication documentation. Regular appraisals ensure insurance coverage keeps pace with market appreciation.

Conclusion

The Rolex market in 2025 represents a mature alternative asset class offering compelling investment characteristics for discerning collectors and sophisticated investors. With 15-year appreciation averaging 323-505% across major collections, combined with lower volatility than traditional assets and exceptional global liquidity, Rolex watches have demonstrated their evolution from luxury timepieces to investable assets deserving portfolio consideration.

Key investment themes driving future performance include supply constraint dynamics, demographic expansion in Asia-Pacific markets, and secular trends toward tangible asset allocation amid monetary policy uncertainty. Selective opportunities exist across collections, with GMT-Master II and Submariner offering optimal risk-adjusted returns, while value-oriented entries through Datejust and Explorer provide accessible exposure to Rolex appreciation potential.

For serious collectors and investment-minded enthusiasts, success requires combining passion for horological excellence with disciplined analytical frameworks that evaluate market fundamentals, authentication standards, and portfolio construction principles. The convergence of Swiss craftsmanship heritage with modern alternative asset characteristics positions Rolex uniquely for sustained long-term performance.

Ready to build your Rolex investment portfolio? [Explore our certified pre-owned Rolex collection] featuring authenticated timepieces with comprehensive documentation and competitive pricing. Our expert team provides personalized guidance for collectors seeking investment-grade acquisitions.

Looking to monetize your current collection? [Get professional Rolex valuation services] with transparent pricing and immediate liquidity options through our established collector network and auction partnerships.

Access exclusive market intelligence through our [Rolex Investment Guide] featuring real-time pricing data, model-specific performance analytics, and strategic acquisition recommendations updated monthly for serious collectors.