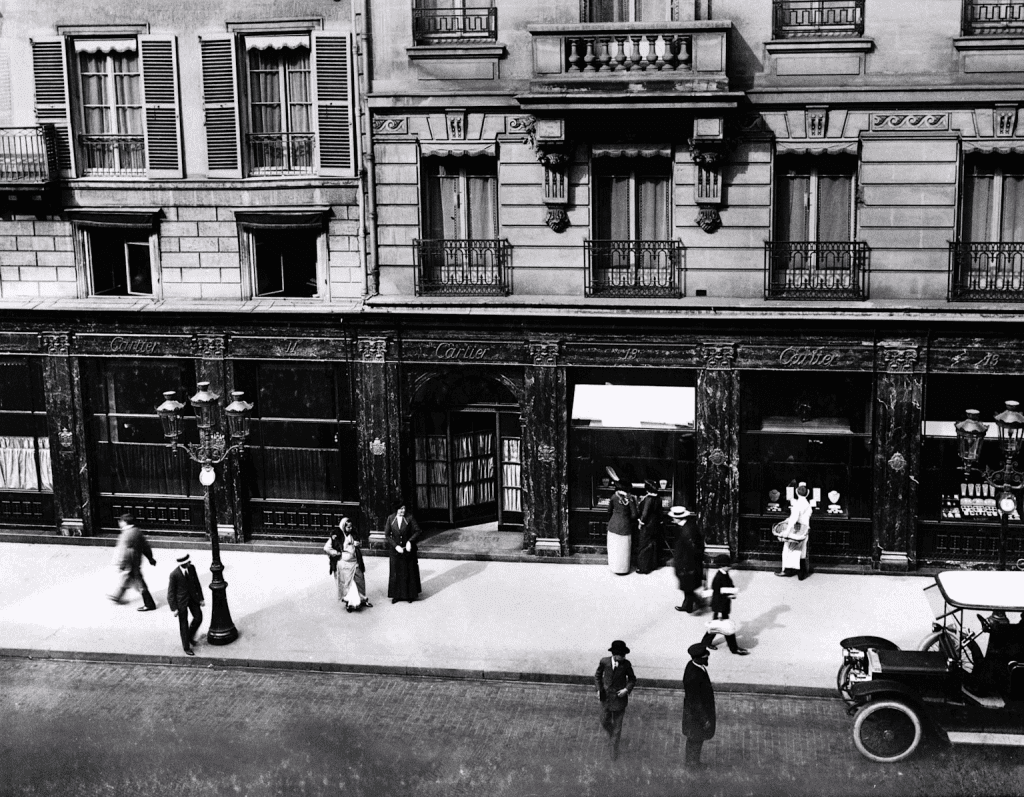

Cartier is more than a luxury fashion house—its watches embody heritage, design excellence, and long-term value. Known as the “Jeweler of Kings, King of Jewelers,” Cartier has a legacy that appeals to both connoisseurs and investors. In 2025, with rising demand among collectors and a luxury watch market projected to reach $134.53 billion by 2032, certain Cartier models show consistent strength in the resale market. Current market data reveals that Cartier watches typically retain 87-99% of their retail value in excellent condition, with some vintage and limited pieces actually appreciating above original retail prices. This guide highlights the factors that shape Cartier’s value retention and identifies the models most likely to deliver investment potential.

Factors That Influence Cartier Value Retention

Key elements driving Cartier watch value include design heritage, scarcity, materials, and cultural impact. Design heritage centers on iconic, timeless lines such as the Tank, Santos, and Ballon Bleu, which have maintained their aesthetic appeal across decades. Scarcity plays a crucial role as limited editions and discontinued references create collector demand—exemplified by the Cartier Crash, which commands over $100,000 at auction due to extremely limited quantities. Materials significantly affect value retention, with gold, platinum, and gem-set versions holding premiums over steel models. Gold and platinum models typically outperform steel versions in terms of percentage gains, while gem-set pieces benefit from intrinsic precious stone value. Cultural impact remains vital, with watches seen on celebrities, royals, and cultural milestones maintaining stronger market appeal. These variables combine to make Cartier watches more than accessories—they become assets with consistent 8-15% annual appreciation for certain vintage Santos models.

Cartier Tank: The Timeless Icon

First created in 1917, inspired by the silhouette of WWI tanks, the Cartier Tank remains a cornerstone of horology. Its clean rectangular case and elegant lines have endured for more than a century, establishing it as Cartier’s flagship investment model with universal appeal. The Tank’s revolutionary rectangular design broke from traditional round cases, creating an instantly recognizable silhouette that defined modern watch aesthetics. Historical significance strengthens its investment appeal—1970s pieces originally costing $1,000 now sell for $8,000-$12,000.

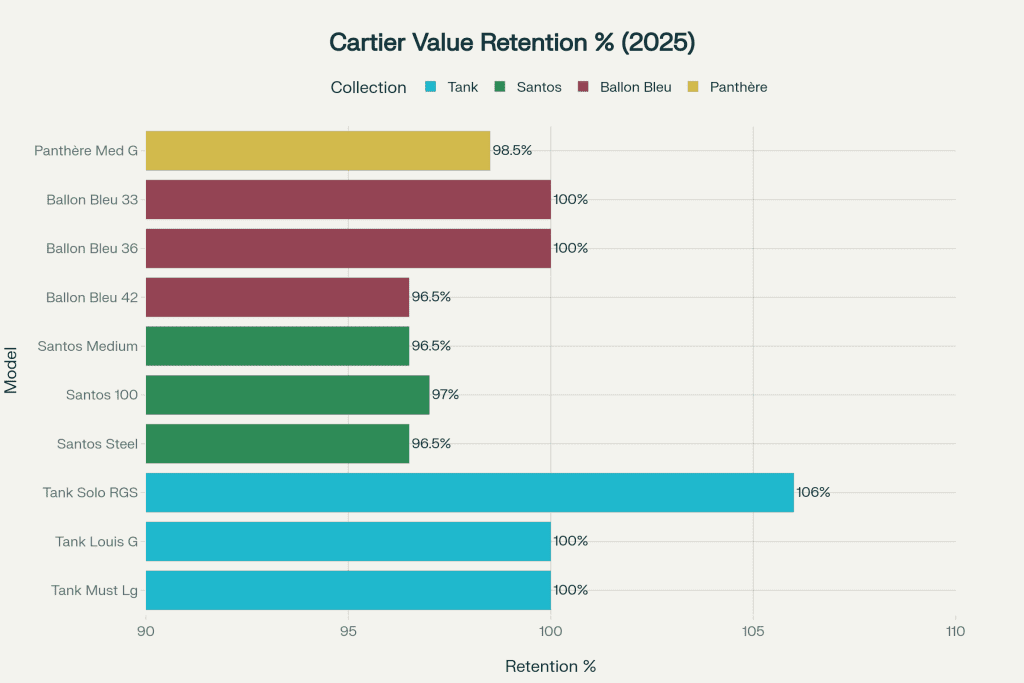

Key models within the Tank collection include the Tank Louis Cartier as the classic dress watch, maintaining 95-105% value retention. The Tank Américaine offers elongated, more modern styling with strong collector interest. The Tank Must serves as the entry-level yet historically important option, retaining 75-125% of retail value. Tank Française models, particularly those in yellow gold, have shown remarkable appreciation—Princess Diana’s Tank Française now worn by Meghan Markle exemplifies the model’s enduring prestige.

Value drivers include constant demand for the Tank’s timeless design and strong association with icons like Jackie Kennedy and Andy Warhol. Current market data shows Tank watches have risen 5.6% in the past 365 days, with the collection ranking as Cartier’s second most popular among collectors. Auction results demonstrate Tank pieces appreciating steadily over decades, with complete documentation commanding 20-30% premiums over watches sold alone.

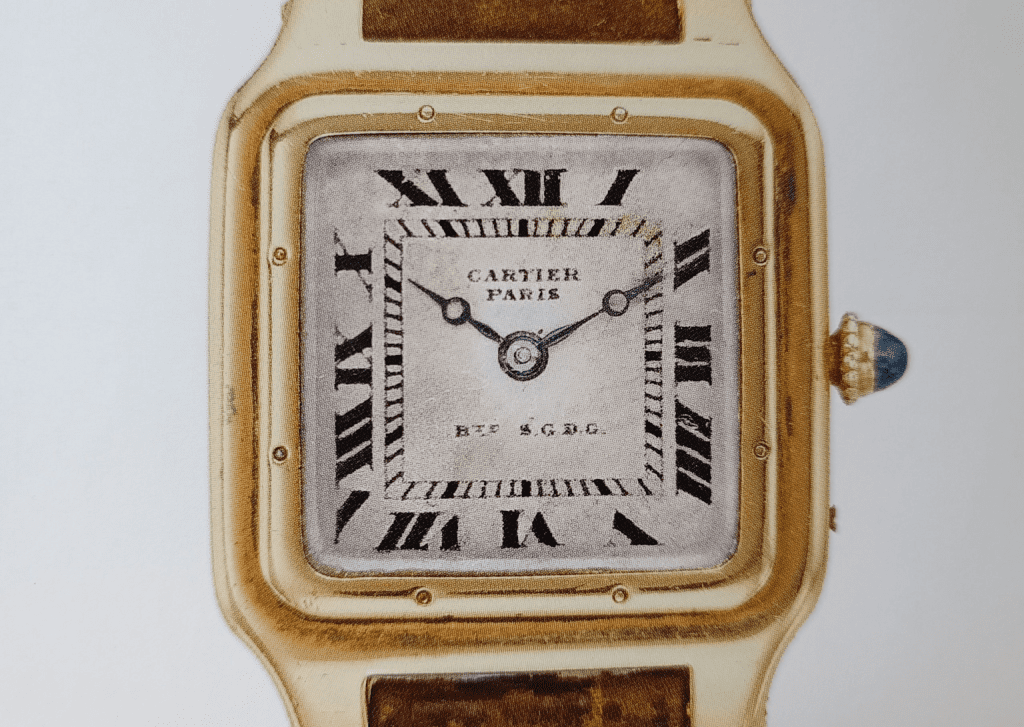

Cartier Santos: The Pioneer’s Watch

The Cartier Santos (1904) holds the distinction of being the world’s first purpose-built men’s wristwatch, created for aviator Alberto Santos-Dumont. Its square case and exposed screws introduced a new language of watch design that remains contemporary over a century later. This historical significance as the first men’s wristwatch provides unmatched heritage value that resonates strongly with collectors.

Modern highlights include Santos de Cartier models in steel and two-tone configurations dominating resale markets. The Santos 100 and chronograph models appeal to contemporary buyers seeking blend of sportiness and elegance. Current market analysis shows Santos de Cartier (Steel) retailing at $7,500 with resale values of $6,800-$8,200, representing strong 91-109% value retention. Santos 100 models show similar resilience with $6,500-$9,000 resale ranges against $8,000 retail pricing.

The Santos retains value due to its groundbreaking “first wristwatch” status and perfect balance of sport and elegance. Secondary market data reveals strong demand often outstripping supply for steel and two-tone models. The 2025 market outlook remains positive with Chrono24 analysis showing Santos models are worth buying in 2025 due to their historical significance and contemporary appeal. Recent innovations including new aviation-inspired Santos-Dumont models continue expanding the collection’s investment potential.

Cartier Ballon Bleu & Other Rising Models

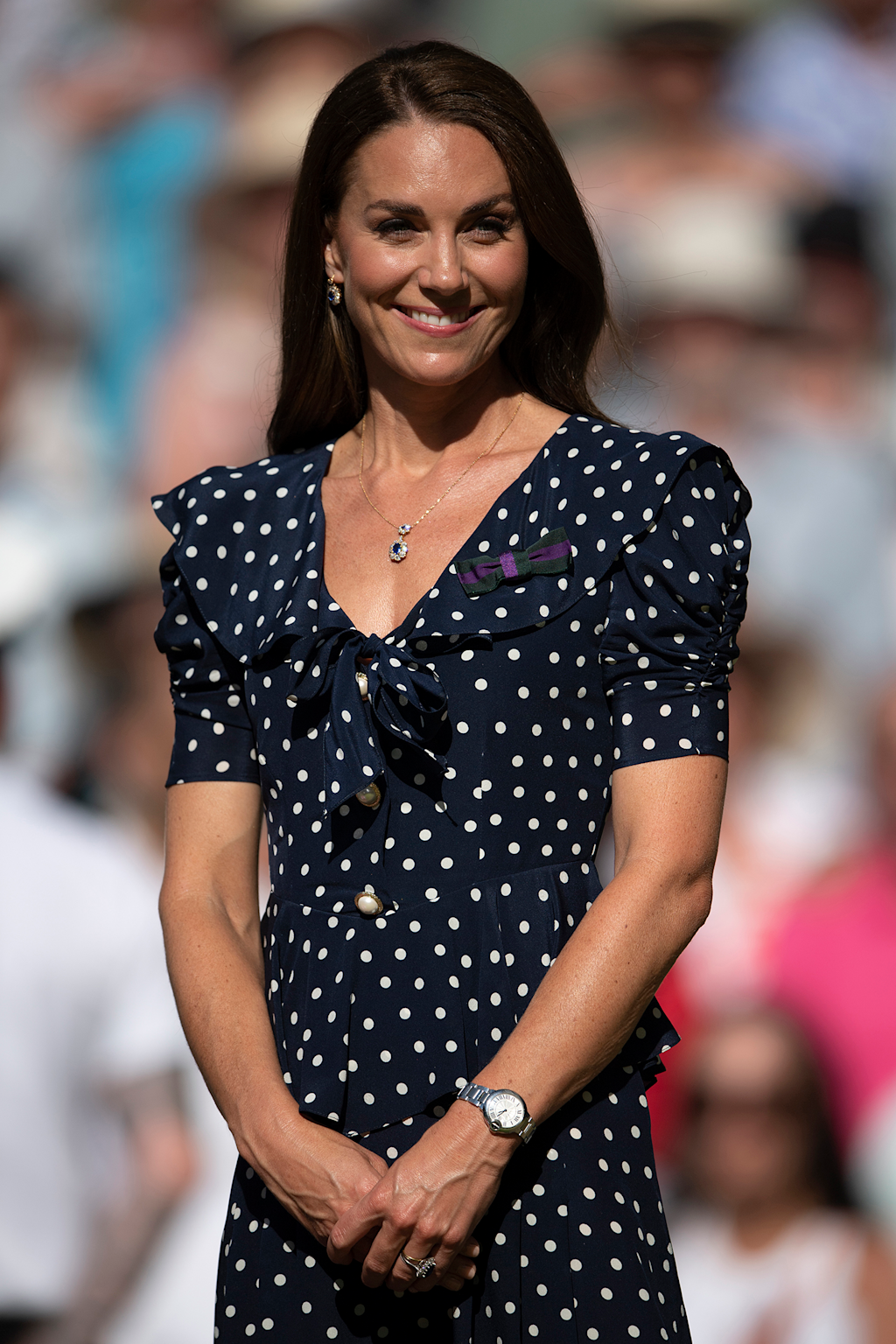

Introduced in 2007, the Ballon Bleu became a bestseller with its rounded case and distinctive crown guard making it instantly recognizable. High-profile wearers like Kate Middleton cement its popularity, with the Princess of Wales frequently spotted wearing her stainless steel Ballon Bleu at public appearances

Current pricing shows Ballon Bleu watches averaging $5,000, though ranges extend from $2,000 to $58,000 depending on materials and complications. Steel 36mm models demonstrate excellent 100% value retention, while 42mm versions maintain 96.5% of retail value.

Market data indicates Ballon Bleu prices decreased 3.3% over the past 180 days, suggesting potential buying opportunities for investors.

Other models gaining traction include the Panthère de Cartier, experiencing renewed interest as a jewelry-watch hybrid. The collection appeals strongly to female collectors and benefits from 2025 price increases of 5.4-7.2% across different variants, indicating Cartier’s confidence in demand. Drive de Cartier and Ronde Solo maintain niche interest with long-term collector potential, particularly as discontinued references become scarcer.

Cartier Limited Editions & High Jewelry Pieces

Some of Cartier’s most lucrative investments emerge from its rarest creations, where extreme scarcity drives exceptional appreciation. The Cartier Crash represents the holy grail of Cartier collecting, with its surreal, melted timepiece design created in extremely limited quantities during the 1960s. Current auction values frequently exceed $100,000, with remarkable examples reaching $1,654,277 for a 1967 London Crash. Recent auction results show a Cartier Crash Model ref. 4131 in white gold selling for CHF 756,000 ($898,732), five times its low pre-sale estimate.

High Jewelry Watches represent another investment category, featuring one-of-a-kind pieces often set with diamonds, sapphires, or emeralds. The 2025 Panthère high-jewelry watch stands as the most sculptural piece in Cartier’s lineup, offered in white gold with 1,103 brilliant-cut diamonds (11.9 carats) and yellow gold versions with graphic lacquer designs. These pieces benefit from both horological and jewelry market dynamics.

Market insights from Sotheby’s and Christie’s auctions demonstrate steady appreciation for Crash and jewelry-set models. The Cartier Cheich, rumored to have only a few examples ever made, sold for a staggering $1.1 million in 2022, highlighting the exceptional returns possible with ultra-rare Cartier pieces. Limited edition releases, such as the Tank à Guichets revival with only 200 platinum pieces, create immediate collectibility.

Cartier vs Other Investment Brands

Compared with Rolex, Patek Philippe, and Audemars Piguet, Cartier occupies a distinctive niche in the luxury watch investment landscape. Rolex dominates tool watches with 90%+ value retention after five years, while Patek Philippe defines haute horology with significant appreciation potential for rare models. Audemars Piguet leads sports-luxury with the Royal Oak collection. Cartier, however, blends jewelry artistry with horological history, creating a unique dual identity.

This jewelry-watch crossover provides Cartier with resilience during market fluctuations. While Rolex focuses on precision and ruggedness, Cartier emphasizes artistry and elegance. Market analysis shows Cartier watches generally retain stable resale value, though they may not experience the same appreciation levels as some Rolex models. However, certain Cartier models, particularly rare or limited-edition pieces, have significant appreciation potential.

Investment positioning reveals Rolex offers more straightforward investment pathways, while Cartier provides exclusivity and jewelry market crossover appeal. The brand’s 88% growth in brand value during 2022 demonstrates its strong market position and investment credentials. Rising demand and continued scarcity ensure Cartier remains sought-after in 2025, with luxury watch market growth projected at 12.23% CAGR through 2032.

Conclusion

In 2025, Cartier continues offering strong investment opportunities across its iconic collections. The Tank delivers timeless appeal with consistent value retention and historical significance spanning over a century. The Santos provides historical importance as the world’s first men’s wristwatch, combined with contemporary relevance and strong resale performance. The Ballon Bleu represents a modern classic with royal endorsement enhancing its investment credentials.

For investors and enthusiasts alike, Cartier delivers both wearable luxury and financial value. Market data confirms 87-99% value retention for most models in excellent condition, with exceptional pieces like the Crash showing extraordinary appreciation potential. The brand’s strategic global expansion with 24 boutiques in 19 major airports and continued innovation ensure sustained market presence.

Next step: Explore Cartier collections in boutiques or trusted online dealers to secure models that will endure in both style and value. Focus on models with complete documentation, excellent condition, and historical significance to maximize investment potential. Consider the Tank Louis Cartier, Santos de Cartier, or select Ballon Bleu models as foundational pieces for a Cartier investment portfolio.