The Rolex Cosmograph Daytona stands as one of the most coveted luxury chronographs in today’s market, therefore commanding premium prices that vary dramatically across different materials. Furthermore, current market data reveals significant price disparities between steel, gold, and platinum variants, with secondary market premiums reaching 132% above retail for certain models. However, understanding these price differences requires examining retail pricing, market availability, and collector demand patterns that have evolved substantially over the past decade.

Steel Daytona Pricing: The Market’s Crown Jewel

Steel Daytonas currently represent the most sought-after segment within the collection, consequently driving extraordinary market premiums that often double retail prices. Moreover, the current steel Daytona (Reference 126500LN) carries a retail price of $15,500 for 2025, yet secondary market pricing ranges from $28,000 for black dial variants to $34,000 for the iconic “Panda” white dial configuration.

Additionally, historical pricing data demonstrates remarkable appreciation, with steel Daytonas climbing from $8,300 in 2010 to current market values exceeding $37,000. Nevertheless, this represents approximately 358% total appreciation over fifteen years, placing the Daytona second only to the GMT-Master II in terms of long-term performance. Furthermore, the previous generation Reference 116500LN, which featured the same ceramic bezel configuration, currently trades between $22,500 and $29,000 depending on dial color.

The steel Daytona’s extraordinary demand stems from several key factors. First, Rolex produces relatively few steel Daytonas annually compared to other models. Second, authorized dealer waitlists extend from two to eight years for steel variants, with many dealers requiring established purchase history before accepting new customers. Third, the combination of motorsports heritage, ceramic bezel technology, and accessible luxury positioning creates broad collector appeal.

Gold Daytona Pricing: Luxury Meets Accessibility

Gold Daytonas occupy a unique market position, offering precious metal luxury while maintaining relative availability compared to steel variants. Currently, solid gold Daytonas range from $38,100 to $50,500 at retail, depending on specific configuration and bezel material. However, these models trade much closer to retail pricing, with premiums typically ranging between 10% and 20% above MSRP.

Yellow gold variants include the Reference 126508 with matching gold bracelet and bezel ($47,000 retail, $49,000 secondary market) and the Reference 126518LN featuring ceramic bezel with Oysterflex rubber strap ($36,400 retail, $42,000 secondary market). Moreover, Everose gold models command similar pricing, with the Reference 126505 retailing for $50,500 while trading near $48,000 in the secondary market.

White gold Daytonas offer “stealth wealth” appeal, particularly the Reference 126519LN with black ceramic bezel, which retails for $38,100 and maintains strong market value around $41,500. Furthermore, precious metal Daytonas benefit from material intrinsic value, providing hedge protection during economic uncertainty while offering shorter waitlist times than steel variants.

The gold market experienced substantial appreciation during 2024, with gold prices increasing 27% year-over-year, consequently driving Rolex to implement price increases averaging 13-19% on solid gold models during 2025. Therefore, gold Daytonas have become increasingly attractive to collectors seeking precious metal exposure without steel model waitlist challenges.

Platinum Daytona Pricing: The Ultimate Luxury Statement

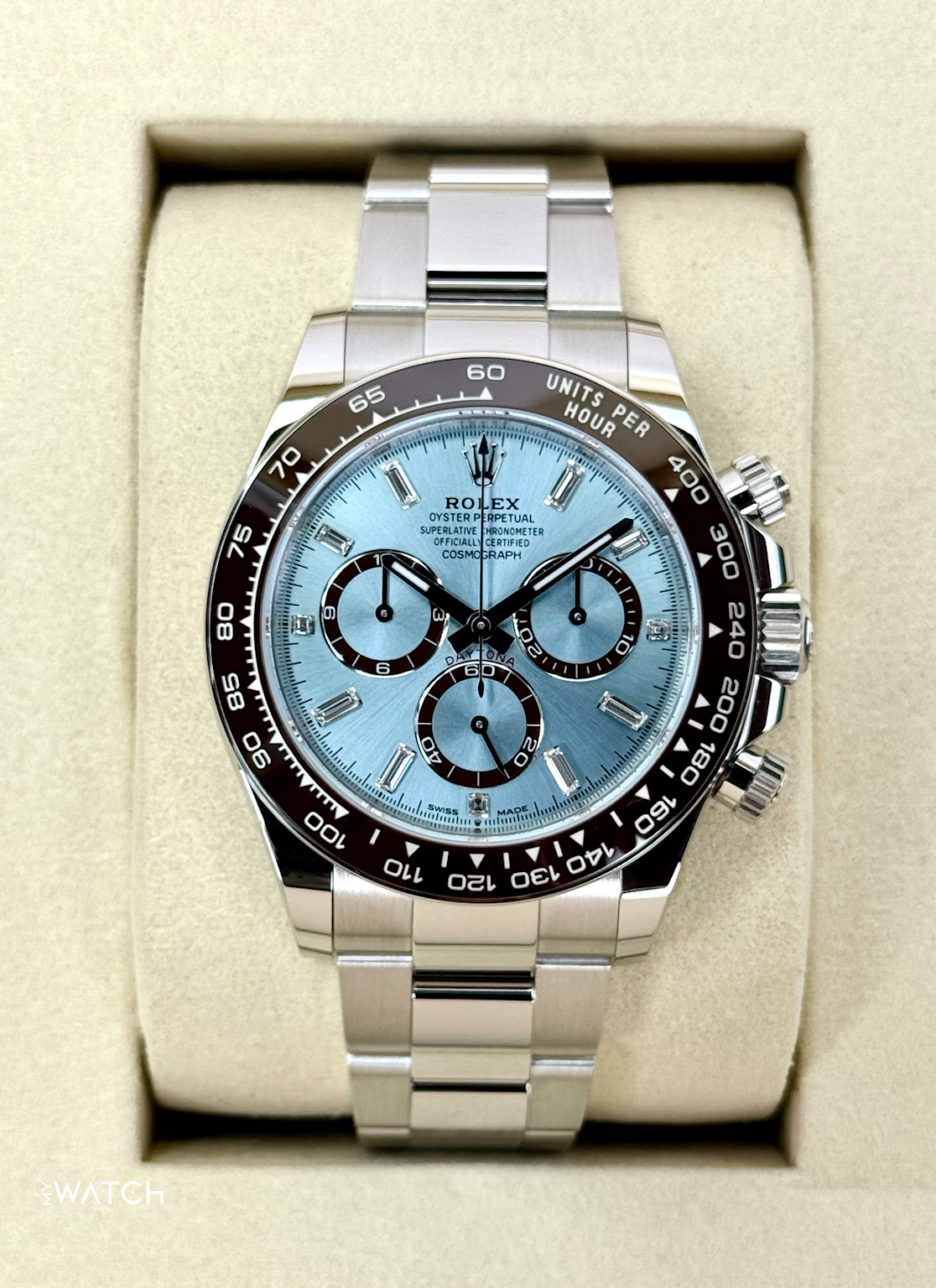

Platinum Daytonas represent the apex of Rolex chronograph luxury, featuring exclusive ice-blue dials available only on platinum models. The current Reference 126506 retails for $78,600 with standard dial configuration, rising to $84,900 for diamond-set variants. Additionally, secondary market pricing reaches $108,000 for standard models and $120,000 for diamond configurations, representing approximately 37% premium above retail.

The platinum Daytona’s distinctive features include 950 platinum construction, providing superior density and corrosion resistance compared to gold variants. Furthermore, the 2023 model introduction brought Rolex’s first exhibition caseback on a modern sports watch, showcasing the decorated Caliber 4131 movement. Moreover, the signature ice-blue dial serves as platinum’s visual identifier, distinguishing these models from steel or white gold alternatives.

Platinum’s rarity drives both pricing and collectibility. Rolex allocates minimal platinum Daytona production to authorized dealers, with some receiving only one or two pieces annually. Consequently, waitlists extend up to five years for platinum models, making them accessible primarily to established high-value customers. However, the substantial investment required limits market demand compared to steel variants, creating more predictable availability for qualified buyers.

Market Trends and Value Retention Analysis

Comprehensive fifteen-year market data reveals distinct appreciation patterns across Daytona materials, with steel models demonstrating highest volatility and growth. Steel Daytonas achieved peak pricing of $53,911 in March 2022 before correcting to current levels around $37,995, illustrating both speculative excess and underlying strength. Nevertheless, this maintains 358% appreciation from 2010 baseline pricing of $8,300.

Gold and platinum models exhibit more stable appreciation curves, benefiting from intrinsic material value and lower speculative trading activity. Additionally, precious metal Daytonas avoided the extreme 2022 pricing peaks experienced by steel variants, therefore experiencing gentler corrections during subsequent market normalization.

Recent market developments indicate continued strength across all materials. However, steel models face ongoing supply constraints, maintaining substantial premiums despite broader luxury watch market corrections. Furthermore, gold models benefit from rising precious metal prices, while platinum variants remain exclusive collector pieces with limited production impact.

Investment performance data suggests steel Daytonas deliver highest absolute returns but with increased volatility risk. Conversely, precious metal variants offer more stable appreciation with intrinsic material value protection, appealing to conservative luxury investors seeking portfolio diversification.

Collector Appeal by Material Segment

Different Daytona materials attract distinct collector demographics, reflecting varying priorities regarding exclusivity, wearability, and investment potential. Steel Daytonas appeal to broad collector bases, including younger enthusiasts, active watch wearers, and investment-focused buyers seeking maximum appreciation potential. Moreover, steel’s durability and scratch resistance make these models ideal for regular wear, aligning with tool watch heritage.

Gold Daytonas attract established collectors valuing precious metal luxury and classic elegance. Furthermore, these buyers often prefer traditional luxury aesthetics over contemporary steel sports watch trends. Additionally, gold variants offer faster acquisition paths for collectors unwilling to navigate extensive steel waitlists.

Platinum Daytonas serve ultra-high-net-worth collectors seeking ultimate exclusivity and craftsmanship. These buyers typically own multiple luxury timepieces and value rarity over broad recognition. Moreover, platinum’s subtle luxury appeal attracts collectors preferring understated wealth displays rather than obvious status symbols.

Vintage Daytona collecting represents separate market dynamics, with Paul Newman dial variants achieving auction records exceeding $17 million. However, these historical pieces occupy specialized collector segments distinct from modern production analysis.

Buying Considerations for US Market

US buyers face specific considerations when selecting Daytona materials, including authorized dealer relationships, financing options, and resale market dynamics. Steel Daytonas require established AD relationships and extensive patience, with realistic acquisition timelines extending multiple years. Therefore, buyers seeking immediate gratification should consider precious metal alternatives or secondary market purchases.

Gold and platinum models offer more accessible purchase paths through authorized dealers, typically requiring six months to two years rather than steel’s extended waitlists. Furthermore, precious metal buyers benefit from financing advantages, as these models maintain stable values for collateral purposes.

Secondary market considerations favor different strategies by material. Steel buyers should verify authenticity carefully due to high counterfeit risk, while precious metal buyers must assess condition and service history given material susceptibility to scratching. Additionally, documentation including box and papers adds 10-20% value across all variants.

US market dynamics also influence material selection. Import duties and state taxes affect precious metal models more significantly than steel variants due to higher initial values. However, precious metal owners benefit from intrinsic material value during currency fluctuations or economic uncertainty.

Conclusion

The Rolex Daytona price analysis reveals distinct market positioning across steel, gold, and platinum variants, each serving different collector priorities and investment objectives. Steel models offer highest appreciation potential with corresponding volatility and availability challenges, making them suitable for patient investors with established dealer relationships. Gold variants provide luxury aesthetics with reasonable availability and stable value retention, appealing to traditional collectors seeking precious metal ownership. Platinum Daytonas represent ultimate exclusivity for ultra-luxury buyers prioritizing rarity and craftsmanship over broad market appeal.

Ultimately, material selection should align with individual priorities regarding wearability, investment timeline, and acquisition strategy. However, all Daytona variants maintain strong long-term value retention prospects, supported by Rolex’s controlled production, brand strength, and enduring collector demand across global luxury markets.

I