M

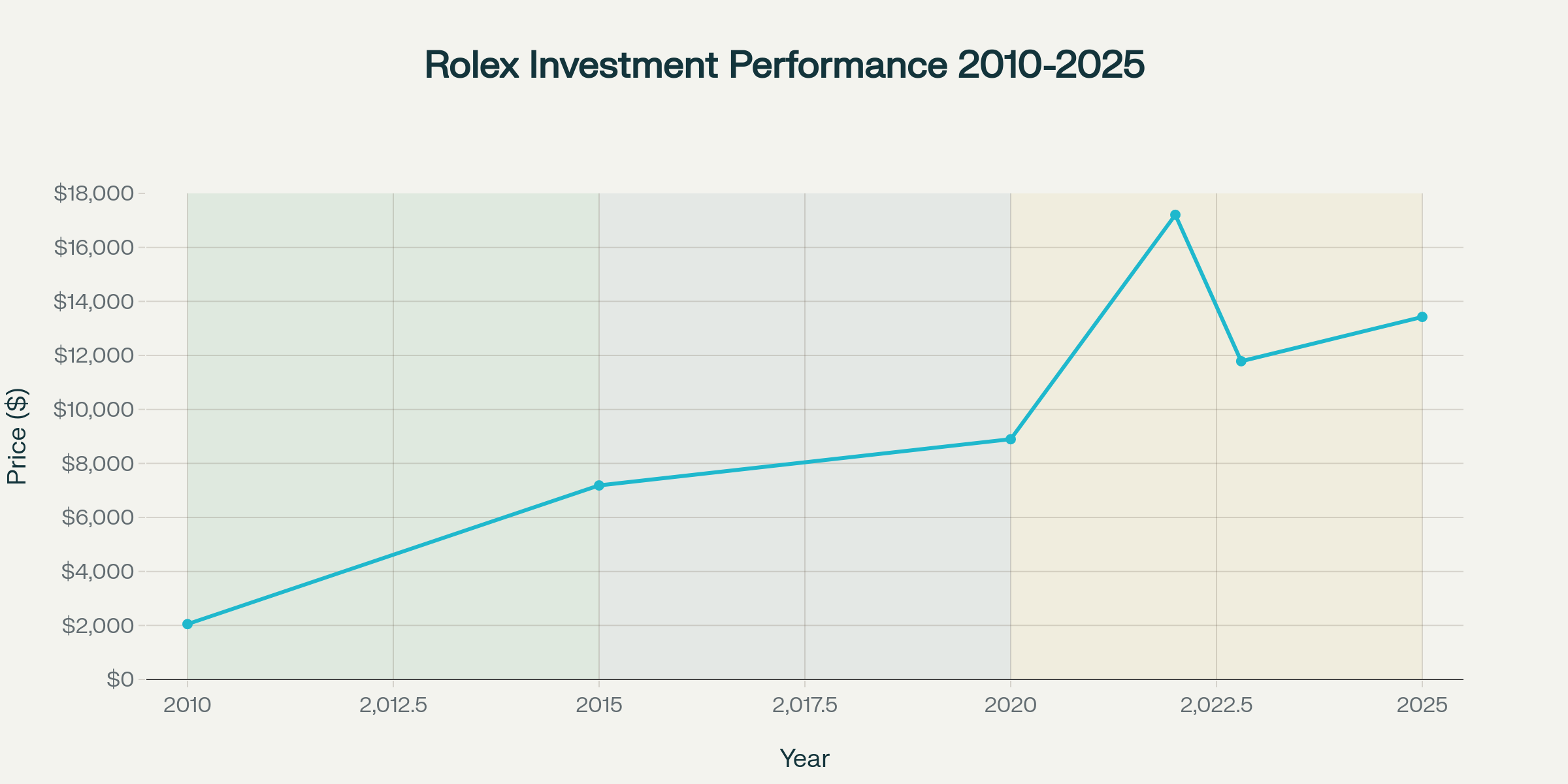

Understanding why Rolex watches hold their value represents crucial knowledge for affluent Americans considering luxury timepieces as alternative investments. Moreover, comprehensive market data reveals that Rolex watches have achieved remarkable 550% average appreciation since 2010, rising from approximately $2,000 to $13,426 in 2025. Furthermore, this exceptional performance stems from carefully orchestrated brand strategies, production controls, and enduring cultural significance that create sustainable demand far exceeding supply.

Brand Prestige and Global Recognition: The Foundation of Value

Heritage and Cultural Impact

Rolex’s unparalleled brand prestige drives consistent global demand across generations and economic cycles. Additionally, the Swiss manufacturer’s century-long history of precision engineering and breakthrough innovations established deep emotional connections with consumers worldwide. Luxury watch market trends demonstrate that cultural significance translates directly into financial performance, with Rolex commanding premium pricing power unavailable to competitors.

Celebrity endorsements and historical achievements reinforce Rolex’s aspirational appeal among affluent buyers. Furthermore, the brand’s association with exploration, sports excellence, and professional achievement creates psychological value extending beyond mere timekeeping functionality. Therefore, this cultural foundation provides crucial stability during market corrections and economic uncertainty.

Market Dominance and Recognition

Rolex maintains an extraordinary 23.4% market share in luxury watches, demonstrating unmatched consumer preference and brand loyalty. Moreover, this dominance translates into pricing power that competitors cannot replicate, enabling consistent value retention even during broader market downturns. Consequently, Rolex investment potential benefits from this market position through sustained demand and premium pricing maintenance.

Limited Supply Strategy: Scarcity Drives Appreciation

Production Control and Annual Output

Rolex strategically limits annual production to approximately 1.05 million watches worldwide, creating intentional scarcity that drives secondary market premiums. Furthermore, this controlled production approach ensures demand consistently exceeds supply across all major markets, supporting price appreciation over time. Additionally, the company maintains fixed percentages for popular steel sports models, making coveted references like the GMT-Master II and Submariner increasingly rare.

Best Rolex models for resale benefit most from these production constraints, with stainless steel sports watches commanding the highest premiums due to limited availability. Moreover, Rolex’s vertical integration and quality standards prevent rapid production increases, maintaining scarcity even as demand grows globally.

Dealer Allocation and Distribution Control

Rolex’s selective dealer network creates additional supply bottlenecks that support value retention. Importantly, authorized dealers receive limited allocations of popular models, often prioritizing established customers and creating extensive waiting lists. Therefore, this distribution strategy transforms new Rolex purchases into immediate equity-building opportunities for fortunate buyers.

Model Desirability: Champions of Collectibility

Steel Sports Models Leading Performance

GMT-Master II models achieved exceptional 506% appreciation since 2010, leading all Rolex collections in investment performance. Additionally, the iconic “Pepsi” and “Batman” bezels command significant premiums due to limited production and collector demand. Furthermore, vintage GMT references continue appreciating as supply diminishes and cultural significance increases.

Submariner references consistently rank among top investment choices, with models like the 116610LN and 126610LN delivering substantial returns. Moreover, the collection’s diving heritage and James Bond associations create enduring collector appeal across demographics. Consequently, both vintage and modern Submariner models maintain strong resale performance in all market conditions.

Chronograph Excellence: Daytona Dominance

Daytona models represent the pinnacle of Rolex investment performance, with steel references regularly selling for double retail prices. Furthermore, the collection’s motorsport heritage and production constraints create exceptional scarcity that drives collector premiums. Additionally, vintage “Paul Newman” Daytona watches achieved record auction results, with Paul Newman’s personal example selling for $17.75 million.

Modern Daytona references (116500LN and 126500LN) continue commanding substantial premiums, making them immediate equity-building investments for buyers accessing retail pricing. Moreover, the collection’s cultural significance and racing connections ensure sustained collector interest across generations.

Market Performance: Data-Driven Investment Analysis

Historical Appreciation Trends

Comprehensive 15-year sales data reveals three distinct phases in Rolex market evolution. Initially, foundation building (2010-2015) generated steady 250% appreciation as the luxury market matured. Subsequently, market maturation (2015-2020) produced moderate 24% growth as prices consolidated gains.

The pandemic era (2020-2022) triggered unprecedented “mania” with prices surging 93% to peak levels of $17,206. However, subsequent correction reduced values 31% before stabilizing at current levels around $13,426, representing sustainable long-term growth. Importantly, this pattern demonstrates Rolex’s ability to recover from corrections while maintaining substantial appreciation.

Current Value Retention Leadership

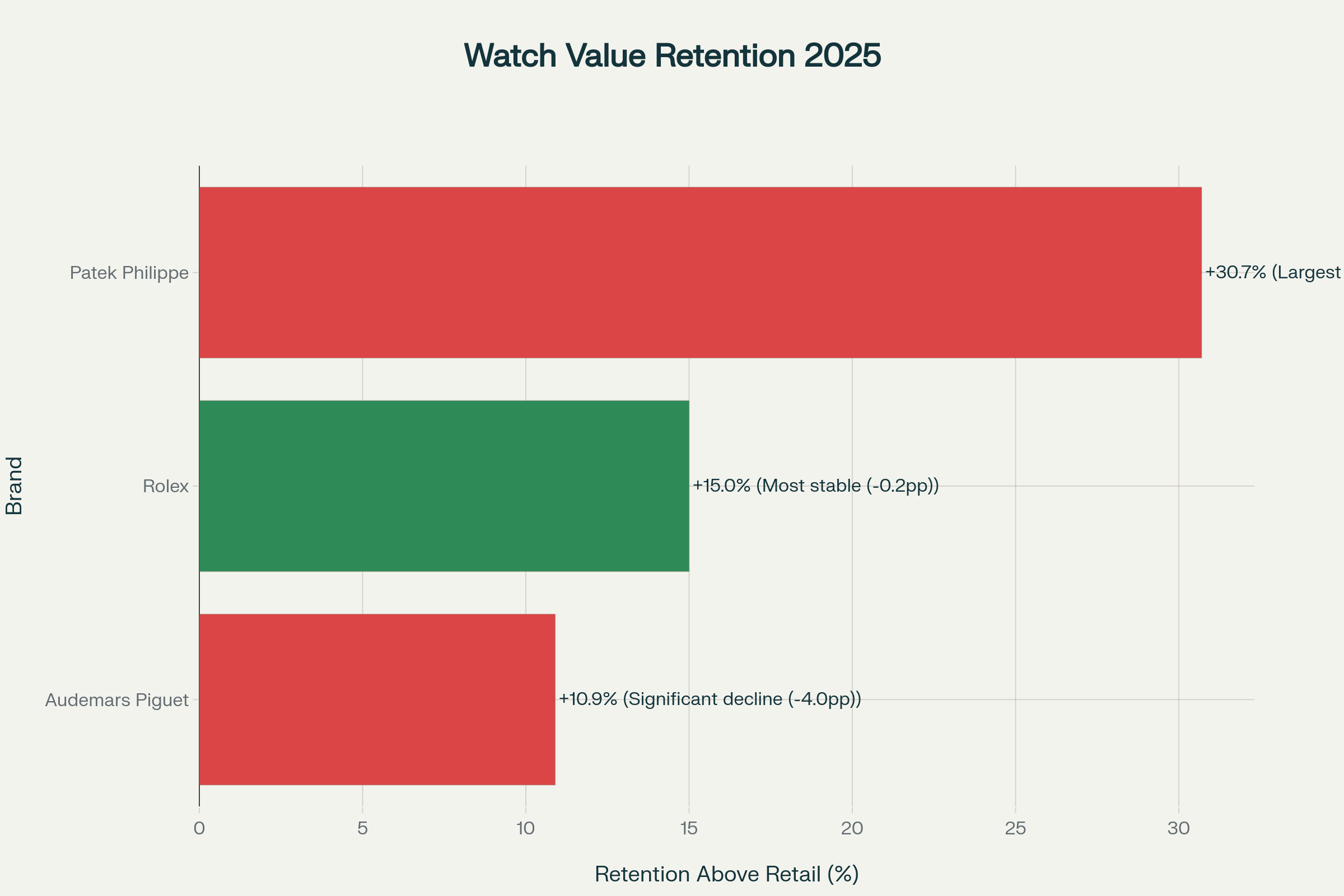

Recent Morgan Stanley analysis reveals Rolex achieved industry-leading value retention at +15.0% above retail prices. Furthermore, Rolex recently overtook Patek Philippe as the top performer in value retention stability, demonstrating superior market resilience. Additionally, 53% of tracked Rolex models continue commanding secondary market premiums despite broader market corrections.

This performance contrasts sharply with competitors experiencing steeper declines, including Patek Philippe (-6.7 percentage points) and Audemars Piguet (-4.0 percentage points). Therefore, Rolex’s stability during market volatility reinforces its position as the premier luxury watch investment.

Economic Resilience: Recession-Proof Performance

Historical Crisis Performance

Luxury watches demonstrate remarkable resilience during economic downturns, with the sector showing the lowest volatility of any alternative asset class. Moreover, Rolex specifically benefits from flight-to-quality behavior during uncertainty, as investors seek tangible assets with proven stability. Furthermore, the brand’s global recognition and liquidity advantage provide crucial benefits during market stress.

Economic data reveals that luxury watch values maintain stability better than many traditional investments during recessions. Additionally, wealthy consumers often view high-end watches as inflation hedges and portfolio diversification tools. Consequently, Rolex watches serve dual purposes as luxury goods and alternative investments during economic uncertainty.

Currency and Global Market Advantages

Rolex’s Swiss franc pricing and global distribution network provide natural currency hedging for US investors. Moreover, the brand’s international recognition ensures liquidity across major markets, facilitating resale opportunities regardless of local economic conditions. Therefore, geographic diversification strengthens Rolex’s investment appeal compared to region-specific assets.

Strategic Buying Approaches for US Investors

Model Selection for Maximum Returns

Steel sports models consistently deliver superior investment performance, with GMT-Master II and Submariner references leading appreciation charts. Additionally, ceramic bezel variants command premium pricing due to enhanced durability and modern aesthetics. Furthermore, discontinued references often experience immediate value increases as supply becomes finite.

Vintage references from the 1960s-1980s achieved 45% five-year annualized returns compared to 30% for modern production. Moreover, entirely original pieces with box and papers command 10-30% premiums over incomplete examples. Therefore, authentication and completeness represent critical factors in investment selection.

Timing and Market Entry Strategies

Current market conditions present compelling entry opportunities following the 2022-2023 correction. Furthermore, price stabilization suggests the luxury watch market may be turning a corner after dramatic boom-bust cycles. Additionally, tariff considerations may stimulate interest in pre-owned models over new purchases.

Pre-owned Rolex investment often provides superior value propositions compared to retail pricing, offering immediate access without waiting lists. Moreover, vintage and discontinued models frequently outperform new production in appreciation potential. Consequently, strategic buyers should focus on authenticated pre-owned examples from reputable dealers.

Investment Risks and Authentication Considerations

Counterfeit Threats and Protection Strategies

Sophisticated counterfeit watches pose significant risks in the luxury market, with fake Rolex models becoming increasingly difficult to detect. Furthermore, purchasing from unauthorized dealers increases counterfeit exposure substantially, potentially costing buyers thousands of dollars. Additionally, online marketplaces present particular risks due to limited verification opportunities.

Professional authentication services provide crucial protection against counterfeit purchases. Moreover, examining serial numbers, movement details, and construction quality helps identify authentic pieces. Therefore, buyers should prioritize dealers offering lifetime authenticity guarantees and comprehensive documentation.

Market Correction and Volatility Risks

Luxury watch market trends demonstrate that even Rolex experiences periodic corrections, as evidenced by the 2022-2023 decline. Furthermore, speculative buying can create unsustainable price bubbles followed by sharp corrections. Additionally, economic downturns particularly impact luxury goods, requiring careful timing and risk management.

Condition and provenance significantly influence resale values, with polished cases and replacement parts reducing investment returns. Moreover, service history and originality become increasingly important factors as watches age. Consequently, proper maintenance and documentation preserve investment potential over time.

Future Outlook: Sustained Excellence

Why Rolex watches hold their value ultimately stems from the brand’s unique combination of heritage, scarcity, and cultural significance that competitors cannot replicate. Furthermore, controlled production, vertical integration, and continuous innovation ensure sustainable competitive advantages. Additionally, global recognition and cross-generational appeal provide stability during market volatility.

Recent market stabilization suggests the luxury watch sector may be entering a more sustainable phase following pandemic-era volatility. Moreover, Rolex’s industry-leading value retention and market position strengthen its investment appeal for affluent US buyers seeking portfolio diversification. Therefore, strategic Rolex purchases represent compelling opportunities to combine luxury enjoyment with proven investment performance.

I