Starting a Patek Philippe collection represents one of the most prestigious journeys in luxury horology. However, the Swiss manufacturer’s exceptional reputation and limited production create unique challenges for new collectors. Moreover, understanding which models offer the best entry points requires careful consideration of price, availability, and long-term value potential. This comprehensive guide explores the essential elements of building your first Patek Philippe collection, from heritage appreciation to strategic acquisition planning.

Why Start with Patek Philippe

Unparalleled Heritage and Craftsmanship

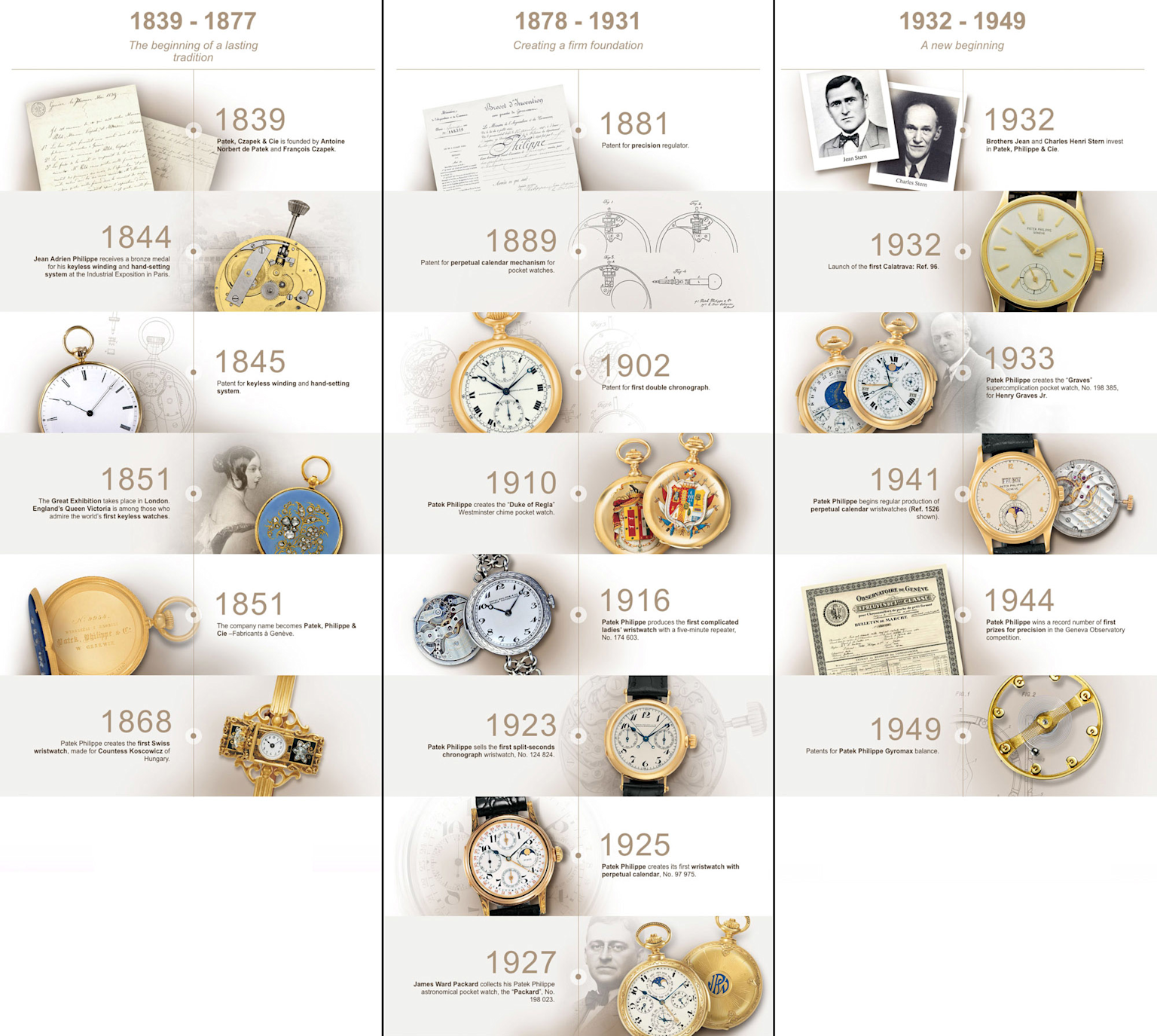

Patek Philippe stands as the last independent, family-owned watch manufacturer in Geneva, maintaining creative freedom that results in exceptional timepieces. Furthermore, the brand’s commitment to excellence spans nearly two centuries, with each watch representing a masterpiece of horological artistry. The company’s motto, “You never actually own a Patek Philippe. You merely look after it for the next generation,” encapsulates the generational value these timepieces represent.

Since 1839, Patek Philippe has consistently pushed the boundaries of watchmaking innovation. Additionally, the brand created the first Swiss wristwatch in 1868 and pioneered numerous complications throughout its history. This legacy of innovation continues today, with the company producing only approximately 50,000 watches annually, ensuring exclusivity and rarity.

Investment Potential and Value Retention

Patek Philippe watches demonstrate exceptional value retention compared to other luxury brands. Consequently, over 50% of the global watch auction market consists of Patek Philippe timepieces, with many world records held by the brand. Nevertheless, collecting should be driven by passion rather than pure investment motives, as market dynamics can fluctuate over time.

The brand’s controlled production strategy maintains scarcity, which drives premium pricing in the secondary market. Therefore, entry-level models often trade above retail prices, particularly for popular sports models like the Aquanaut. However, this premium reflects both desirability and the difficulty of obtaining pieces directly from authorized dealers.

Entry-Level Patek Philippe Models

Aquanaut Collection: Modern Sporty Elegance

The Aquanaut 5167A-001 serves as an excellent entry point for new collectors, with an MSRP of $25,958. Moreover, this stainless steel timepiece features a distinctive embossed dial pattern and comfortable rubber strap. The 40.8mm case houses the reliable Caliber 26-330 S C movement, providing 45 hours of power reserve.

However, market prices significantly exceed retail, with the 5167A trading around $53,000-$55,000 in 2025. Additionally, the rose gold variant 5167R commands approximately $70,000 on the secondary market. Despite premium pricing, the Aquanaut’s modern aesthetic appeals to younger collectors seeking contemporary luxury.

Calatrava Collection: Timeless Dress Watch Excellence

The Calatrava represents Patek Philippe’s quintessential dress watch, with the 5227J serving as an accessible yellow gold option. Furthermore, this 39mm timepiece embodies classical elegance with its clean dial design and date display at 3 o’clock. The current MSRP stands at $44,870, though secondary market prices hover around $27,000, offering relative value.

Vintage Calatrava models, particularly the discontinued 3919, present attractive opportunities for budget-conscious collectors. Nevertheless, these pieces require careful authentication and condition assessment when purchasing pre-owned. The 3919’s manual-wind movement and timeless aesthetic make it an undervalued classic.

Twenty-4 Collection: Ladies’ Luxury Accessibility

The Twenty-4 4910 represents the most affordable entry into Patek Philippe ownership, with stainless steel models starting at $17,058 MSRP. Additionally, pre-owned examples trade for $9,900-$10,000, making them highly accessible. The rectangular case design and quartz movement provide practicality alongside prestige.

However, diamond-set versions command significantly higher prices, with gold variants reaching $35,000-$60,000. Moreover, the Twenty-4’s feminine design limits its appeal to specific collectors, though recent automatic variants expand the collection’s reach.

Price Ranges and Market Trends

Current Market Dynamics

Patek Philippe prices have experienced a 10.8% decline over the past year, creating opportunities for strategic buyers. However, this correction primarily affects less popular models, while sports pieces maintain premium pricing. Therefore, understanding market segments becomes crucial for successful collecting.

| Year | Aquanaut 5167A (MSRP) | Aquanaut 5167A (Market) | Calatrava 5227J (MSRP) | Calatrava 5227J (Market) | Twenty-4 4910 (MSRP) | Twenty-4 4910 (Market) |

| 2015 | 22000 | 25000 | 39000 | 30000 | 14000 | 8000 |

| 2016 | 22500 | 27000 | 39500 | 28000 | 14500 | 8500 |

| 2017 | 23000 | 30000 | 40000 | 26000 | 15000 | 9000 |

| 2018 | 23500 | 35000 | 40500 | 25000 | 15500 | 9500 |

| 2019 | 24000 | 40000 | 41000 | 24000 | 16000 | 10000 |

| 2020 | 24500 | 45000 | 41500 | 26000 | 16200 | 9000 |

| 2021 | 25000 | 55000 | 42000 | 28000 | 16500 | 8500 |

| 2022 | 25500 | 65000 | 42500 | 30000 | 16800 | 9000 |

| 2023 | 25900 | 58000 | 43000 | 27000 | 17000 | 9500 |

| 2024 | 25958 | 55000 | 44000 | 26000 | 17058 | 10000 |

| 2025 | 25958 | 53000 | 44870 | 27000 | 17058 | 9900 |

Entry-Level Price Segments

The most accessible entry points begin around $10,000 for vintage or pre-owned pieces. Furthermore, the Twenty-4 quartz models offer genuine Patek Philippe ownership at relatively modest prices. However, mainstream collecting typically starts with $25,000-$50,000 budgets for contemporary models.

Nevertheless, market premiums significantly impact acquisition costs, particularly for steel sports models. Additionally, complicated timepieces like annual calendars and chronographs command substantially higher prices, often exceeding $100,000. Therefore, new collectors should focus on time-only models initially.

Long-Term Value Trends

Historical data reveals consistent appreciation for most Patek Philippe models over extended periods. Moreover, discontinued references often see increased demand as availability decreases. However, market cycles affect short-term pricing, requiring patience for optimal acquisition timing.

The brand’s limited production ensures long-term scarcity, supporting value retention. Additionally, Patek Philippe’s archival services provide unprecedented documentation for every timepiece produced. This level of record-keeping enhances authenticity verification and collector confidence.

Buying Channels and Verification

Authorized Dealers vs. Secondary Market

Authorized dealers provide guaranteed authenticity and full warranty coverage, though availability remains severely limited. Moreover, building relationships with authorized dealers requires time and often substantial purchase history. However, retail pricing offers the best value when pieces become available.

Conversely, the secondary market offers immediate availability but requires careful verification. Additionally, prices typically exceed retail by 50-200% for popular models. Nevertheless, reputable dealers provide authentication services and condition reports to mitigate risks.

Authentication Essentials

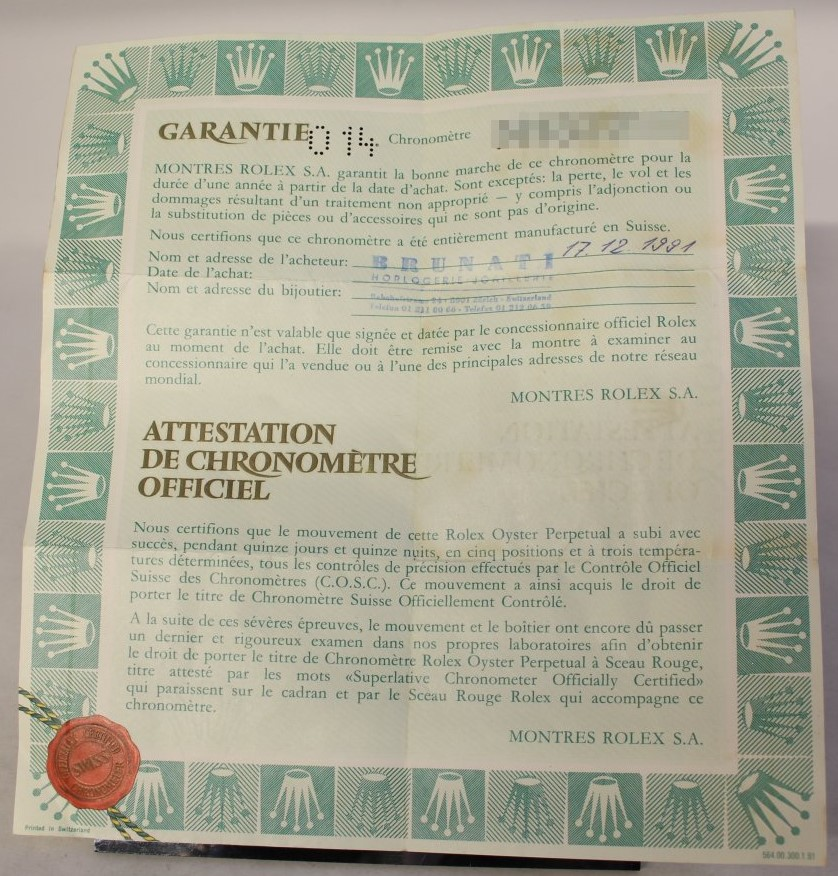

Serial number verification represents the primary authentication method for Patek Philippe timepieces. Furthermore, the brand’s Extract from the Archives service provides definitive authenticity confirmation for pieces over 10 years old. However, this service costs 500 Swiss francs and takes several weeks to complete.

Physical inspection should focus on case finishing, dial quality, and movement decoration. Additionally, authentic papers and boxes significantly enhance value and provide additional authentication evidence. Nevertheless, experienced collectors can identify authentic pieces through detailed examination of craftsmanship details.

Red Flags and Common Fakes

Counterfeit Patek Philippe watches often display serial numbers on visible case backs, which authentic pieces never feature. Moreover, poor engraving quality, incorrect fonts, and substandard finishing indicate potential fakes. However, high-quality replicas require expert evaluation to detect.

Weight differences often reveal counterfeit pieces, as authentic Patek Philippe watches use premium materials resulting in substantial heft. Additionally, movement decoration and finishing quality distinguish authentic pieces from even sophisticated fakes. Therefore, professional authentication becomes essential for significant purchases.

Long-Term Collection Strategy

Building Your Foundation

New collectors should begin with a single, high-quality piece rather than multiple lower-tier alternatives. Furthermore, focusing on iconic models like the Calatrava or Aquanaut provides strong foundational value. However, personal preference should ultimately guide initial selections.

Diversification across collections enhances long-term portfolio value and collecting enjoyment. Additionally, mixing dress and sports models provides versatility for different occasions. Nevertheless, maintaining focus on specific preferences prevents unfocused accumulation.

Progression Pathways

After establishing an entry-level foundation, collectors typically progress toward complicated timepieces. Moreover, annual calendars, world timers, and chronographs represent logical next steps. However, these complications require significantly larger budgets, often exceeding $75,000-$150,000.

Vintage collecting offers alternative progression paths, with discontinued references providing unique character. Additionally, pocket watches represent an underappreciated segment with strong historical significance. Nevertheless, condition assessment becomes even more critical for vintage pieces.

Advanced Collecting Considerations

Grand complications represent the pinnacle of Patek Philippe collecting, though prices often exceed $500,000. Furthermore, limited editions and special series command premium pricing and require quick decision-making. However, these pieces appeal primarily to advanced collectors with substantial experience.

Market timing becomes increasingly important for significant acquisitions, as economic cycles affect luxury goods demand. Additionally, establishing relationships with multiple dealers expands access to rare pieces. Nevertheless, patience remains essential, as the best pieces often require years to acquire.

Starting your Patek Philippe collection requires careful planning, patience, and appreciation for horological excellence. However, the rewards extend far beyond mere timekeeping, offering entry into one of luxury’s most exclusive communities. Therefore, begin with thorough research, establish clear goals, and embrace the journey toward building a meaningful collection that can be treasured for generations.