In an era of unprecedented market volatility, geopolitical uncertainty, and economic turbulence, high-net-worth individuals and wealth managers are increasingly turning to ultra-luxury real estate as the cornerstone of their generational wealth strategies. While traditional asset classes experience wild fluctuations, ultra-high-end properties continue to demonstrate remarkable resilience, offering a unique combination of capital preservation, growth potential, and tangible security that no other investment vehicle can match.

From Monaco’s prestigious penthouses to Dubai’s waterfront villas, ultra-luxury real estate has consistently outperformed other asset classes during periods of crisis, making it one of the safest luxury assets for discerning investors. This comprehensive analysis explores why sophisticated investors continue to invest in high-end real estate as their primary wealth preservation strategy, examining performance data, global market dynamics, and strategic approaches that define this exclusive investment landscape.

Why Real Estate Beats Volatility

Superior Crisis Performance Across Multiple Decades

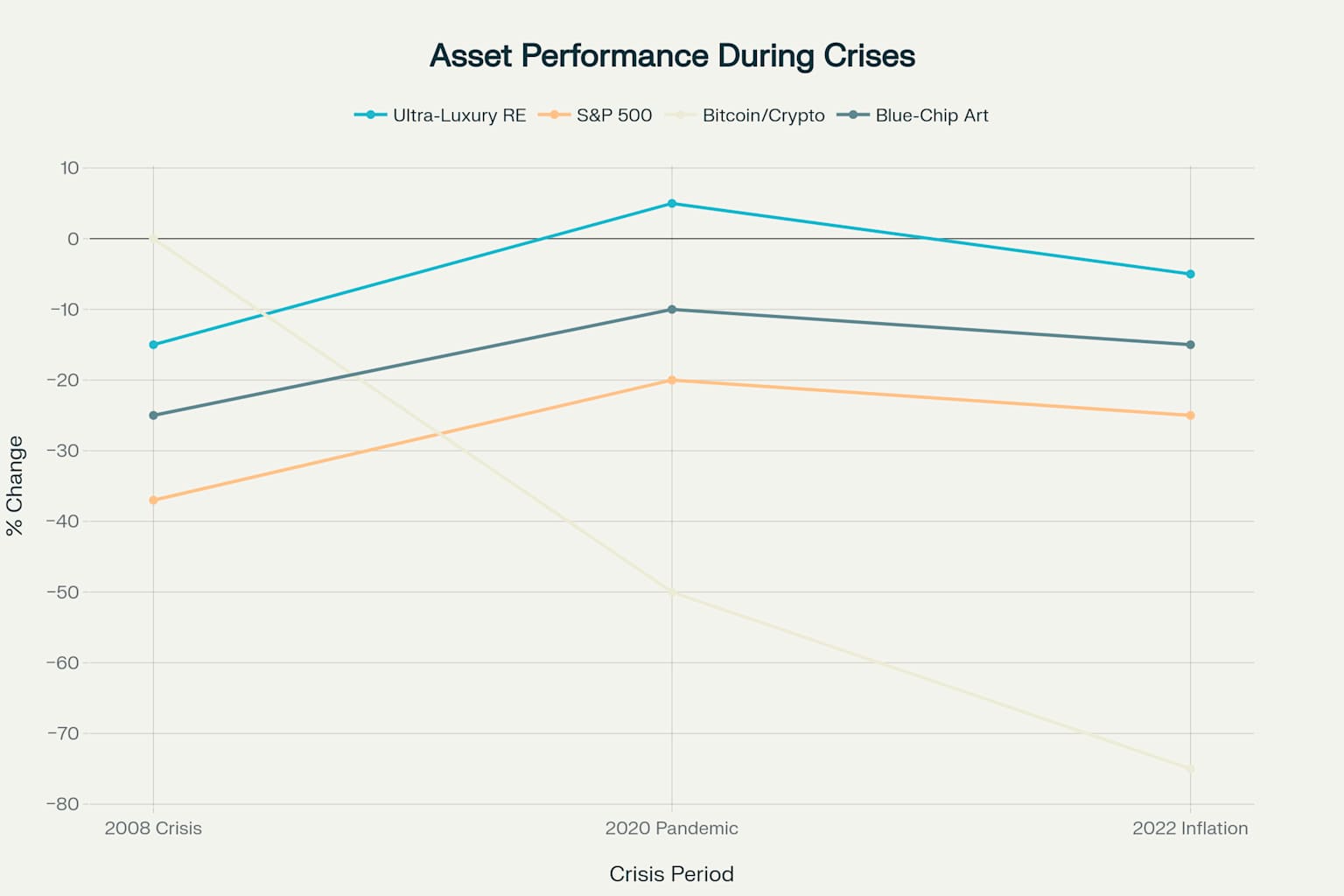

Ultra-luxury real estate has demonstrated unparalleled resilience during major economic disruptions over the past 25 years. Unlike stocks, cryptocurrencies, or even traditional real estate, the ultra-high-end segment has consistently provided downside protection when other assets faltered.

During the 2008 financial crisis, while the S&P 500 plummeted 37% and blue-chip art declined 25%, ultra-luxury real estate experienced only a 15% decline before recovering rapidly. The 2020 COVID pandemic actually saw luxury properties appreciate 5% as wealthy buyers sought safe havens and lifestyle upgrades, while Bitcoin crashed 50% and stocks fell 20%.

Key Performance Metrics:

- Average annual returns: 8-12% for ultra-luxury properties

- Volatility: Significantly lower than equities and crypto

- Downside protection: Superior to all major asset classes

- Recovery time: Typically 12-18 months vs. 3-5 years for stocks

The Inflation Hedge Advantage

Ultra-luxury real estate serves as an exceptional hedge against inflation, consistently outpacing currency debasement and maintaining purchasing power. Unlike bonds or cash equivalents that lose value during inflationary periods, high-end properties benefit from:

- Replacement cost increases due to rising materials and labor costs

- Rental income escalation keeping pace with or exceeding inflation

- Land scarcity in prime locations driving continued appreciation

- Construction limitations in established luxury markets creating supply constraints

What Makes Luxury Property Crash-Resistant

Supply Scarcity in Prime Locations

The fundamental driver of ultra-luxury real estate stability lies in the mathematical impossibility of creating more prime land. Whether it’s Monaco’s coastline, Manhattan’s Central Park vicinity, or Miami’s Biscayne Bay waterfront, the most desirable locations have finite supply and virtually unlimited global demand.

Supply Constraint Factors:

- Zoning restrictions limiting new construction in established areas

- Environmental regulations protecting coastal and historic districts

- Height limitations preserving neighborhood character

- Infrastructure capacity preventing overdevelopment

High Entry Barriers Create Stable Demand

Ultra-luxury properties typically require $10 million to $100 million+ investments, creating natural barriers that limit market participation to a select group of ultra-high-net-worth individuals (UHNWIs). This exclusivity provides several stabilizing factors:

- Cash purchases predominate (70-80% of transactions), eliminating financing risks

- Long-term holding periods reduce market churn and volatility

- Emotional attachment to trophy properties decreases selling pressure

- Generational transfers keep properties within wealthy families

Global UHNWI Demand Continues Growing

The world’s ultra-wealthy population continues expanding, creating sustained demand for luxury real estate. Key demographic trends include:

- UHNWI population growing at 3-5% annually worldwide

- Wealth concentration increasing in major financial centers

- Generational wealth transfers approaching $84 trillion over the next two decades

- Geographic diversification driving cross-border luxury property investment

Cities Leading the Market

Monaco: The Ultimate Safe Haven

Monaco remains the world’s most expensive and exclusive real estate market, with properties averaging $5,167 per square foot. The principality’s unique advantages include:

- Zero personal income tax for residents

- Political stability and security

- Limited territory (less than one square mile) ensuring scarcity

- Royal and celebrity appeal maintaining prestige

2024 saw total sales volumes reach €5.8 billion, with new developments like Mareterra commanding over €100,000 per square meter for the most exclusive units.

Miami: The Gateway to Latin America

Miami’s luxury market has emerged as a global powerhouse, leading U.S. price growth with 6.5% appreciation in 2024. The city’s competitive advantages include:

- No state income tax for U.S. and international buyers

- Strategic location connecting North and South America

- Cultural diversity appealing to global investors

- Strong rental yields from luxury vacation and corporate housing

Ultra-luxury sales totaled $2.67 billion in 2024, with properties in exclusive enclaves like Fisher Island and Star Island commanding premium valuations.

Dubai: The Emerging Global Hub

Dubai’s transformation into a luxury real estate destination has been remarkable, offering some of the world’s highest rental yields (5-8%) combined with strong capital appreciation. Key attractions include:

- Golden Visa program providing long-term residency

- Tax-free environment for individuals and corporations

- World-class infrastructure and connectivity

- Diverse property types from beachfront villas to branded residences

The emirate recorded $14.6 billion in ultra-prime sales during 2024, establishing itself as a premier destination for global wealth.

London: Traditional Excellence Meets Opportunity

Despite recent challenges from tax policy changes, London’s prime central markets continue attracting international capital. The city offers:

- Historic prestige and cultural significance

- Educational excellence with world-renowned schools and universities

- Financial services hub maintaining global relevance

- Relative value with properties 20% below 2014 peaks

Prime markets like Mayfair, Belgravia, and Knightsbridge remain highly sought after by sophisticated investors seeking long-term value.

Luxury Rental ROI: Cash Flow Meets Appreciation

High-End Short-Term Rentals Transform Returns

The evolution of luxury hospitality has created unprecedented opportunities for ultra-high-end property owners to generate substantial rental income while maintaining their assets for personal use. Premium short-term rentals in trophy destinations now command:

- $10,000-50,000 per week for luxury villas and penthouses

- 80-90% occupancy rates in prime destinations during peak seasons

- Corporate housing premiums for executive relocations

- Event hosting income for special occasions and celebrations

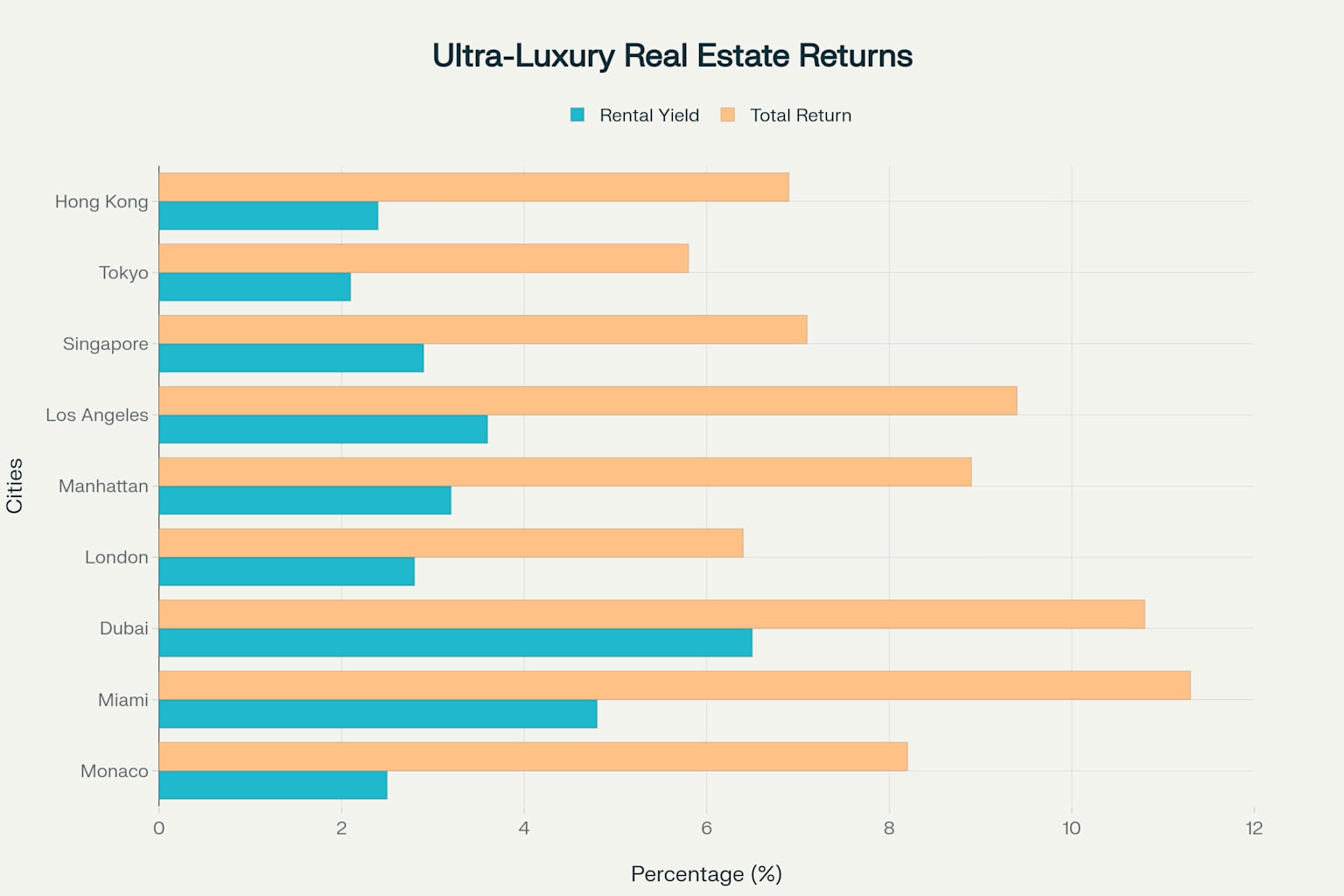

Geographic Rental Yield Variations

Different markets offer varying combinations of rental yield and capital appreciation potential:

High-Yield Markets:

- Dubai: 6.5% average rental yields

- Miami: 4.8% average yields with strong appreciation

- Selected Caribbean markets: 5-7% yields

Capital Appreciation Leaders:

- Monaco: Lower yields (2.5%) but exceptional long-term appreciation

- Manhattan: Moderate yields (3.2%) with inflation-plus growth

- London: Currently offering value with recovery potential

Tax-Efficient Ownership Structures

Sophisticated investors leverage various structures to optimize their luxury real estate investments:

- International holding companies for cross-border tax efficiency

- Trust structures for generational wealth transfer

- 1031 exchanges for U.S. property portfolio optimization

- Depreciation benefits reducing current tax obligations

Strategic Investment Approaches

Direct Ownership vs. Fund Participation

Ultra-luxury real estate investment strategies vary based on capital availability, risk tolerance, and involvement preferences:

Direct Ownership Benefits:

- Complete control over property selection and management

- Maximum tax advantages and depreciation benefits

- Personal use and enjoyment capabilities

- Direct exposure to appreciation and rental income

Real Estate Fund Advantages:

- Professional management and due diligence

- Geographic and property type diversification

- Lower capital requirements ($250K-$1M minimum)

- Improved liquidity through fund structures

Asset-Backed Financing Strategies

Sophisticated investors increasingly utilize their luxury real estate holdings as collateral for additional investments:

- Securities-backed credit lines using property as additional collateral

- Real estate leverage for portfolio expansion

- Cross-collateralization across multiple properties

- Estate planning benefits through strategic borrowing

Minimizing Risk Through Strategic Selection

Location Supremacy

The three most critical factors in ultra-luxury real estate investment success remain: location, location, and location. Prime characteristics include:

- Proximity to financial centers ensuring sustained demand

- Natural barriers (waterfront, mountains, parks) limiting supply

- Infrastructure excellence supporting luxury lifestyles

- Political stability protecting long-term value

Brand Partnership Premium

Branded residences have emerged as a distinct asset class, offering superior investment characteristics through global recognition and service standards. Leading brands include:

Four Seasons Private Residences:

- Global brand recognition and service standards

- Professional property management included

- Resale value premiums of 20-30% over comparable properties

- Access to hotel amenities and services

Aman Residences:

- Ultra-exclusive positioning and limited availability

- Architectural excellence and unique design

- Wellness-focused amenities and services

- Strong appreciation potential due to scarcity

Other Premium Brands:

- Ritz-Carlton Residences

- Mandarin Oriental Residences

- St. Regis Residences

- Baccarat Residences

Exclusivity and Scarcity Factors

The most successful ultra-luxury investments share common characteristics that ensure long-term value preservation:

- Limited inventory in prime locations

- Unique architectural features or historical significance

- Privacy and security features

- Concierge and lifestyle services included

- Access to exclusive amenities (private clubs, marinas, golf courses)

Future-Proofing Your Portfolio

Emerging Market Opportunities

While established markets provide stability, emerging luxury destinations offer enhanced growth potential:

- Asian financial centers (Singapore, Tokyo, Hong Kong)

- Secondary U.S. markets (Austin, Nashville, Denver)

- European alternatives (Lisbon, Barcelona, Amsterdam)

- Emerging Gulf states beyond Dubai

Sustainability and Technology Integration

Modern luxury properties increasingly incorporate:

- LEED certification and sustainable building practices

- Smart home technology and automation systems

- Renewable energy integration reducing operating costs

- Wellness-focused design meeting evolving buyer preferences

Generational Wealth Transfer Considerations

As $84 trillion in wealth transfers to younger generations over the next two decades, ultra-luxury real estate provides:

- Tangible legacy assets families can enjoy together

- Inflation protection for long-term wealth preservation

- Tax-efficient transfer mechanisms through proper structuring

- Income generation supporting family financial needs

The Enduring Appeal of Ultra-Luxury Real Estate

Ultra-luxury real estate has consistently proven itself as one of the safest luxury assets available to sophisticated investors, offering a unique combination of capital preservation, growth potential, and lifestyle benefits that no other asset class can match. Through careful selection of prime locations, strategic structuring, and professional management, high-net-worth individuals can build robust generational wealth strategies that weather economic storms while providing both financial returns and personal enjoyment.

The decision to invest in high-end real estate represents more than a financial calculation—it’s a commitment to tangible, appreciating assets that provide security, prestige, and legacy value for generations. As global wealth continues concentrating among ultra-high-net-worth individuals, and supply constraints in prime locations intensify, ultra-luxury real estate will likely continue outperforming traditional asset classes while offering the stability and growth that sophisticated investors demand.

Key Investment Principles for Success:

- Prioritize location and scarcity above all other factors

- Consider branded residences for enhanced value and services

- Implement tax-efficient ownership structures from the outset

- Maintain a long-term perspective aligned with generational wealth goals

- Diversify across multiple prime markets to optimize risk-adjusted returns

True wealth isn’t just built — it’s protected. Here’s how high-end real estate continues to do both.

Whether you’re establishing your first ultra-luxury property position or expanding an existing portfolio, the fundamentals of prime location, limited supply, and global demand continue supporting this asset class as the cornerstone of sophisticated wealth management strategies. In an uncertain world, ultra-luxury real estate remains the ultimate safe haven for those who understand that true wealth preservation requires both vision and patience.